Alternative Minimum Tax (AMT) Credit Examples

Alternative Minimum Tax (AMT) Credit - how incentive stock options trigger alternative minimum tax and how alternative minimum tax credits are used to offset regular tax liability.

Hi everyone. My name is Tan and I am an independent Certified Financial Planner Practitioner at TAN Wealth Management. In today’s educational video, I will go over 4 scenarios so you can better understand how incentive stock options trigger alternative minimum tax and how alternative minimum tax credits are used to offset regular tax liability.

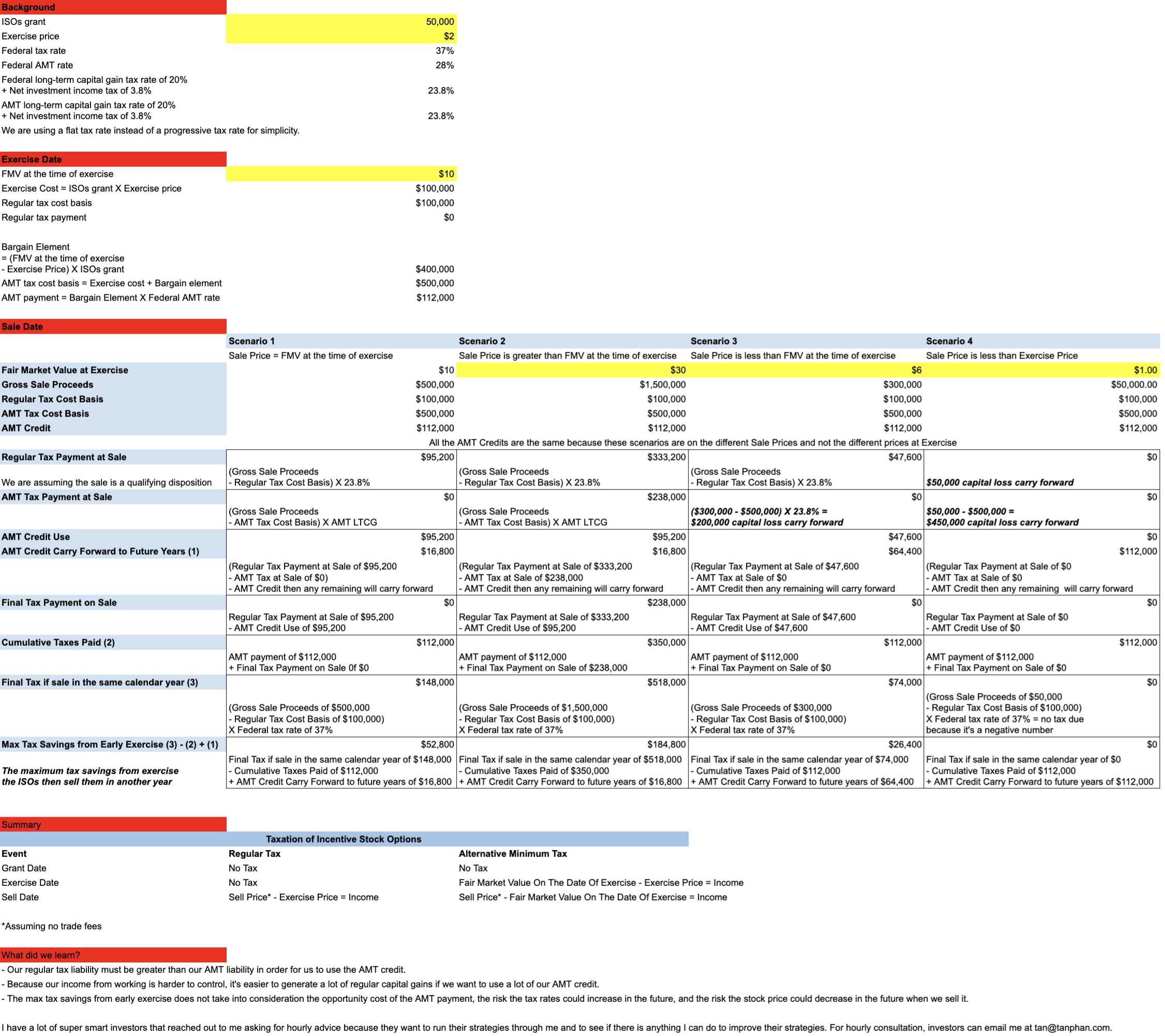

Your company granted you 50,000 ISOs and the exercise price is $2 per share. The federal tax rate is 37%. The federal AMT rate is 28%. The federal long-term capital gain tax rate of 20% plus the net investment income tax of 3.8% equals 23.8%. The AMT long-term capital gain tax rate of 20% plus the net investment income tax of 3.8% equals 23.8%. We are using a flat tax rate instead of a progressive tax rate for simplicity. We are only talking about alternative minimum tax credit at the federal level and we are not going to talk about the alternative minimum tax credit at the state level because different states have different tax rates.

The fair market value at the time of exercise is $10 per share. 50,000 ISOs times the exercise cost of $2 per share equals $100,000. $100,000 is the exercise cost. That $100,000 will also be your regular tax cost basis. You don’t have a tax liability for regular tax purposes because you spend after-tax dollars to exercise the ISOs and you have not sold any stock. Think of exercising as buying. You don’t pay taxes when you buy stocks in the market. You pay taxes when you sell the shares and have a gain.

The fair market value at the time of exercise of $10 minus the exercise price of $2 per share then times 50,000 ISOs equals $400,000. $400,000 is the bargain element. The exercise cost of $100,000 plus the bargain element of $400,000 equals the AMT tax cost basis of $500,000. $500,000 is the AMT tax cost basis. The bargain element of $400,000 times the federal AMT rate of 28% equals the AMT payment of $112,000. $112,000 is the AMT credit we can use for future years. In all 4 scenarios, the AMT credits are the same which are $112,000 because these scenarios are on the different sale prices and not the different prices at exercise.

Scenario 1:

If the sale price of $10 equals the fair market value at the time of exercise of $10.

50,000 ISOs times the sale price of $10 equals the gross sale proceeds of $500,000. 50,000 ISOs times the exercise cost of $2 per share equals $100,000. $100,000 is the regular tax cost basis. The exercise cost of $100,000 plus the bargain element of $400,000 equals the AMT cost basis of $500,000. The bargain element of $400,000 times the federal AMT rate of 28% equals the AMT payment of $112,000.

The gross sale proceeds of $500,000 minus the regular tax cost basis of $100,000 then times 23.8% equals the regular tax at sale of $95,200. The 23.8% consists of the federal long-term capital gain tax rate of 20% plus the net investment income tax of 3.8%.

The gross sale proceeds of $500,000 minus the AMT tax cost basis of $500,000 then times the AMT long-term capital gains of 23.8% equals $0. There is a $0 AMT tax at sale.

The regular tax at sale of $95,200 minus the AMT tax at sale of $0 equals $95,200. $95,200 is the most AMT credit we can use for the taxable year. If we have remaining AMT credit, we can carry it forward and use it for future years. We have an AMT credit of $112,000 and we use $95,200. $16,800 is the AMT credit we are going to carry forward so we can use it for future years.

The regular tax at sale of $95,200 minus the AMT credit use of $95,200 equals the final tax on sale of $0. The $0 means we don’t have a tax liability from selling the shares because our AMT credit absorbed the regular tax payment of $95,200. This does not mean we don’t have a tax liability from other incomes, such as earned income from working. This just means we don’t have a tax liability from selling the shares.

The cumulative taxes paid is $112,000 which is taxes paid from the previous year. We do not have a tax liability from selling the shares because the AMT credit absorbed the regular tax payment of $95,200.

Remember, the purpose of this educational video is to learn how the alternative minimum tax credit can be utilized when we sell the shares at different prices.

Whenever we exercise incentive stock options and sell them within the same calendar year, we don’t have to worry about the bargain element. This is assuming we exercised the ISOs at $2 per share and sold them for $10 per share. We have a gain of $8 per share then we multiply it by 50,000 ISOs equals $400,000 in gains. $400,000 in gains times the federal tax rate of 37% equals $148,000. $148,000 is the tax payment if we exercised the ISOs at $2 per share then sold them for $10 per share in the same calendar year. There is no bargain element of $400,000 and AMT tax payment of $112,000 because we exercised the ISOs and sold them within the same calendar year. We did this so we can see what the maximum tax savings will be from exercising the ISOs then selling them in another year.

The final tax if sale in the same calendar year of $148,000 minus the cumulative taxes paid of $112,000 plus the AMT credit carry forward to future years of $16,800 equals $52,800. $52,800 is the maximum tax savings from exercising the ISOs, selling them in the same calendar year, and paying the federal tax rate of 37% to exercising the ISOs, paying AMT on the bargain element, carrying forward the AMT credit, offsetting the AMT credit with the regular tax liability, and carrying the AMT credit to be used in future years.

Scenario 2:

If the sale price of $30 is greater than the fair market value at the time of exercise of $10.

50,000 ISOs times the sale price of $30 equals the gross sale proceeds of $1,500,000. 50,000 ISOs times the exercise cost of $2 per share equals $100,000. $100,000 is the regular tax cost basis. The exercise cost of $100,000 plus the bargain element of $400,000 equals the AMT cost basis of $500,000. The bargain element is $400,000 because the exercise cost is $2 per share and the fair market value of the stock at exercise is $10 per share. The bargain element of $8 per share times 50,000 ISOs equals the total bargain element of $400,000. The bargain element of $400,000 times the federal AMT rate of 28% equals the AMT payment of $112,000.

The gross sale proceeds of $1,500,000 minus the regular tax cost basis of $100,000 then times 23.8% equals the regular tax at sale of $333,200.

The gross sale proceeds of $1,500,000 minus the AMT tax cost basis of $500,000 then times the AMT long-term capital gains of 23.8% equals $238,000. $238,000 is the AMT tax payment at sale.

The regular tax payment at sale of $333,200 minus the AMT tax payment at sale of $238,000 equals $95,200. $95,200 is the most AMT credit we can use for the taxable year. If we have remaining AMT credit, we can carry it forward and use it for future years. We have an AMT credit of $112,000 and we use $95,200. $16,800 is the AMT credit we are going to carry forward so we can use it for future years.

The regular tax payment at sale of $333,200 minus the AMT credit use of $95,200 equals the final tax payment on sale of $238,000.

The AMT payment of $112,000 plus the final tax payment on sale of $238,000 equals the cumulative taxes paid of $350,000.

The gross sale proceeds of $1,500,000 minus the regular tax cost basis of $100,000 then times the federal tax rate of 37% equals the final tax if sale in the same calendar year of $518,000. Whenever we exercise incentive stock options and sell them within the same calendar year, we don’t have to worry about the bargain element. This is assuming we exercised the ISOs at $2 per share and sold them for $30 per share. We have a gain of $28 per share then we multiply it by 50,000 ISOs equals $1,400,000 in gains. $1,400,000 in gains times the federal tax rate of 37% equals $518,000. $518,000 is the tax payment if we exercised the ISOs at $2 per share then sold them for $30 per share in the same calendar year. There is no bargain element of $400,000 and AMT tax payment of $112,000 because we exercised the ISOs and sold them within the same calendar year. We did this so we can see what the maximum tax savings will be from exercising the ISOs then selling them in another year.

The final tax if sale in the same calendar year of $518,000 minus the cumulative taxes paid of $350,000 plus the AMT credit carry forward to future years of $16,800 equals $184,800. $184,800 is the maximum tax savings from exercising the ISOs, selling them in the same calendar year, and paying the federal tax rate of 37% to exercising the ISOs, paying AMT on the bargain element, carrying forward the AMT credit, offsetting the AMT credit with the regular tax liability, and carrying forward the AMT credit to be use in future years.

Scenario 3:

If the sale price of $6 is less than the fair market value at the time of exercise of $10.

50,000 ISOs times the sale price of $6 equals the gross sale proceeds of $300,000. 50,000 ISOs times the exercise cost of $2 per share equals $100,000. $100,000 is the regular tax cost basis. The exercise cost of $100,000 plus the bargain element of $400,000 equals the AMT cost basis of $500,000. The bargain element is $400,000 because the exercise cost is $2 per share and the fair market value of the stock at exercise is $10 per share. The bargain element of $8 per share times 50,000 ISOs equals the total bargain element of $400,000. The bargain element of $400,000 times the federal AMT rate of 28% equals the AMT payment of $112,000.

The gross sale proceeds of $300,000 minus the regular tax cost basis of $100,000 then times 23.8% equals the regular tax at sale of $47,600.

The gross sale proceeds of $300,000 minus the AMT tax cost basis of $500,000 equals a capital loss carry forward of $200,000. We did not have an AMT tax payment when we sold the stock because we sold the stock at a loss.

The regular tax payment at sale of $47,600 minus the AMT tax payment at sale of $0 equals $47,600. We can use the AMT credit of $112,000 to offset the regular tax payment at sale of $47,600. Thus, we use $47,600 of the AMT credit and carry forward the remaining AMT credit of $64,400 ($112,000 - $47,600).

The regular tax payment at sale of $47,600 minus the AMT credit use of $47,600 equals the final tax payment on sale of $0.

The AMT payment of $112,000 plus the final tax payment on sale of $0 equals the cumulative taxes paid of $112,000.

The gross sale proceeds of $300,000 minus the regular tax cost basis of $100,000 then times the federal tax rate of 37% equals the final tax if sale in the same calendar year of $74,000. Whenever we exercise incentive stock options and sell them within the same calendar year, we don’t have to worry about the bargain element. This is assuming we exercised the ISOs at $2 per share then sold them for $4 per share. We have a gain of $4 per share. $4 per share multiply by 50,000 ISOs equals a gain of $200,000. A gain of $200,000 times the federal tax rate of 37% equals $74,000. $74,000 is the tax payment if we exercised the ISOs at $2 per share then sold them for $6 per share in the same calendar year. There is no bargain element of $400,000 and AMT tax payment of $112,000 because we exercised the ISOs and sold them within the same calendar year. We did this so we can see what the maximum tax savings will be from exercising the ISOs then selling them in another year.

The final tax if sale in the same calendar year of $74,000 minus the cumulative taxes paid of $112,000 plus the AMT credit carry forward to future years of $64,400 equals $26,400. $26,400 is the maximum tax savings from exercising the ISOs, selling them in the same calendar year, and paying the federal tax rate of 37% to exercising the ISOs, paying AMT on the bargain element, carrying forward the AMT credit, offsetting the AMT credit with the regular tax liability, and carrying forward the AMT credit to be use in future years.

Scenario 4:

If the sale price of $1 is less than the exercise price of $2.

50,000 ISOs times the sale price of $1 equals the gross sale proceeds of $50,000. 50,000 ISOs times the exercise cost of $2 per share equals $100,000. $100,000 is the regular tax cost basis. The exercise cost of $100,000 plus the bargain element of $400,000 equals the AMT cost basis of $500,000. The bargain element is $400,000 because the exercise cost is $2 per share and the fair market value of the stock at exercise is $10 per share. The bargain element of $8 per share times 50,000 ISOs equals the total bargain element of $400,000. The bargain element of $400,000 times the federal AMT rate of 28% equals the AMT payment of $112,000.

The gross sale proceeds of $50,000 minus the regular tax cost basis of $100,000 equals $50,000 capital loss carry forward.

The gross sale proceeds of $50,000 minus the AMT tax cost basis of $500,000 equals a capital loss carry forward of $450,000. We did not have an AMT tax payment when we sold the stock because we sold the stock at a loss.

The regular tax payment at sale of $0 minus the AMT tax payment at sale of $0 equals $0. Because it’s $0, we cannot use any AMT credit so we are going to continue to carry forward the AMT credit of $112,000 to be used in future years.

The regular tax payment at sale of $0 minus the AMT credit use of $0 equals the final tax payment on sale of $0.

The AMT payment of $112,000 plus the final tax payment on sale of $0 equals the cumulative taxes paid of $112,000.

The gross sale proceeds of $50,000 minus the regular tax cost basis of $100,000 then times the federal tax rate of 37% equals no tax due because it’s a negative number. Thus, the final tax if sale in the same calendar year is $0.

The final tax if sale in the same calendar year of $0 minus the cumulative taxes paid of $112,000 plus the AMT credit carry forward to future years of $112,000 equals $0. $0 is the maximum tax savings from exercising the ISOs then selling them in the same calendar year to exercising the ISOs, paying AMT on the bargain element, and carrying forward the AMT credit to be used in future years.

Taxation summary of incentive stock options.

For regular tax purposes:

- No tax on the grant date.

- No tax on the exercise date.

- The sell price minus the exercise price equals the income on the sell date. The income can be taxed at capital gains tax rates or ordinary income tax rates depending if it’s a qualifying disposition or disqualifying disposition.

For alternative minimum tax purposes:

- No tax on the grant date.

- The fair market value on the date of exercise minus the exercise price equals the income on the exercise date.

- The sell price minus the fair market value on the date of exercise equals the income on the sell date.

What did we learn?

- Our regular tax liability must be greater than our AMT liability in order for us to use the AMT credit.

- Because our income from working is harder to control, it's easier to generate a lot of regular capital gains if we want to use a lot of our AMT credit.

- The max tax savings from early exercise does not take into consideration the opportunity cost of the AMT payment, the risk the tax rates could increase in the future, and the risk the stock price could decrease in the future when we sell it.

Please note that this material is for educational use only. Tax laws are complex, there are exceptions to the rules, and it’s constantly changing. Be sure to talk to a qualified professional before making an informed decision. Thank you for watching. Until next time. This is Tan, your Trusted Advisor.