Certified Financial Planner Board of Standards - 2025 Tax Tables

2025 Single Individuals Income Tax Rates

2025 Married Individuals Filing Jointly And Surviving Spouses Income Tax Rates

2025 Married Individuals Filing Separately Income Tax Rates

2025 Heads Of Households Income Tax Rates

2025 Net Investment Income Tax

2025 Additional Medicare Tax

2025 Long-term Capital Gains Rates

2025 Estates And Non-grantor Trusts Income Tax Rates

2025 Standard Deductions

2025 Retirement Plan Contribution Limits & Phase-outs

2025 Estate And Gift Tax Rates & Exemptions

2025 Social Security Wage Base & Earnings Limits

Social Security Full Retirement Ages

2025 Health Savings Account Limits

2025 Education Phase Outs

2025 Alternative Minimum Tax (AMT) Exemptions, Phase Outs & Rates

Certified Financial Planner Board of Standards - 2024 Tax Tables

2024 Single Individuals Income Tax Rates

2024 Married Individuals Filing Jointly And Surviving Spouses Income Tax Rates

2024 Married Individuals Filing Separately Income Tax Rates

2024 Heads Of Households Income Tax Rates

2024 Net Investment Income Tax

2024 Additional Medicare Tax

2024 Long-term Capital Gains Rates

2024 Estates And Non-grantor Trusts Income Tax Rates

2024 Standard Deductions

2024 Retirement Plan Contribution Limits & Phase-outs

2024 Estate And Gift Tax Rates & Exemptions

2024 Social Security Wage Base & Earnings Limits

Social Security Full Retirement Ages

2024 Health Savings Account Limits

2024 Education Phase Outs

2024 Alternative Minimum Tax (AMT) Exemptions, Phase Outs & Rates

Certified Financial Planner Board of Standards - 2023 Tax Tables

2023 Single Individuals Income Tax Rates

2023 Married Individuals Filing Jointly And Surviving Spouses Income Tax Rates

2023 Married Individuals Filing Separately Income Tax Rates

2023 Heads Of Households Income Tax Rates

2023 Net Investment Income Tax

2023 Additional Medicare Tax

2023 Long-term Capital Gains Rates

2023 Estates And Non-grantor Trusts Income Tax Rates

2023 Standard Deductions

2023 Retirement Plan Contribution Limits & Phase-outs

2023 Estate And Gift Tax Rates & Exemptions

2023 Social Security Wage Base & Earnings Limits

Social Security Full Retirement Ages

2023 Health Savings Account Limits

2023 Education Phase Outs

2023 Alternative Minimum Tax (Amt) Exemptions, Phase Outs & Rates

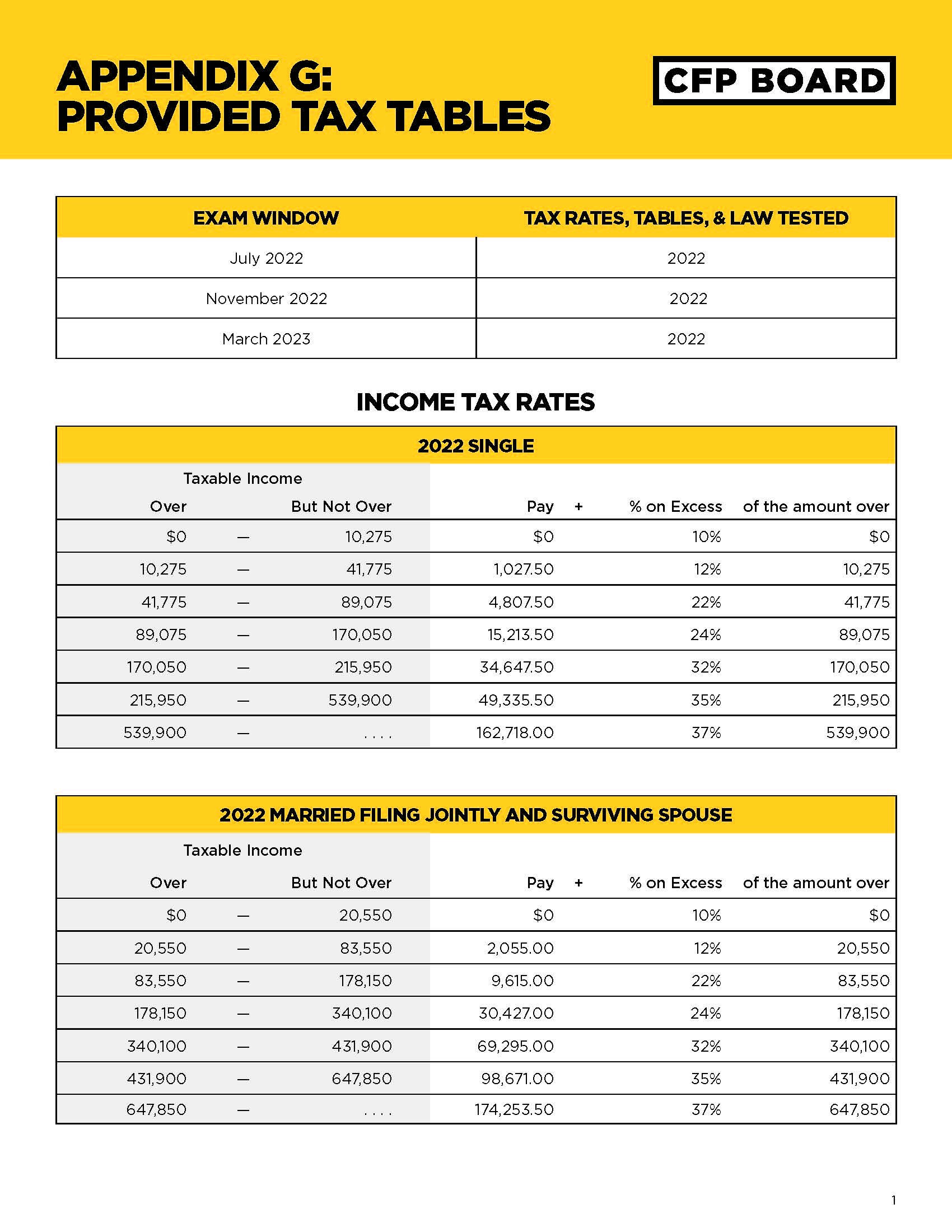

Certified Financial Planner Board of Standards - 2022 Tax Tables

2022 Single Individuals Income Tax Rates

2022 Married Individuals Filing Jointly And Surviving Spouses Income Tax Rates

2022 Married Individuals Filing Separately Income Tax Rates

2022 Heads Of Households Income Tax Rates

2022 Net Investment Income Tax

2022 Additional Medicare Tax

2022 Long-term Capital Gains Rates

2022 Estates And Non-grantor Trusts Income Tax Rates

2022 Standard Deductions

2022 Retirement Plan Contribution Limits & Phase-outs

2022 Estate And Gift Tax Rates & Exemptions

2022 Social Security Wage Base & Earnings Limits

Social Security Full Retirement Ages

2022 Health Savings Account Limits

2022 Education Phase Outs

2022 Alternative Minimum Tax (Amt) Exemptions, Phase Outs & Rates

Certified Financial Planner Board of Standards - 2021 Tax Tables

2021 Single Individuals Income Tax Rates

2021 Married Individuals Filing Jointly And Surviving Spouses Income Tax Rates

2021 Married Individuals Filing Separately Income Tax Rates

2021 Heads Of Households Income Tax Rates

2021 Net Investment Income Tax

2021 Additional Medicare Tax

2021 Long-term Capital Gains Rates

2021 Estates And Non-grantor Trusts Income Tax Rates

2021 Standard Deductions

2021 Retirement Plan Contribution Limits & Phase-outs

2021 Estate And Gift Tax Rates & Exemptions

2021 Social Security Wage Base & Earnings Limits

Social Security Full Retirement Ages

2021 Health Savings Account Limits

2021 Education Phase Outs

2021 Alternative Minimum Tax (Amt) Exemptions, Phase Outs & Rates

Certified Financial Planner Board of Standards - 2020 Tax Tables

2020 Single Individuals Income Tax Rates

2020 Married Individuals Filing Jointly And Surviving Spouses Income Tax Rates

2020 Married Individuals Filing Separately Income Tax Rates

2020 Heads Of Households Income Tax Rates

2020 Net Investment Income Tax

2020 Additional Medicare Tax

2020 Long-term Capital Gains Rates

2020 Estates And Non-grantor Trusts Income Tax Rates

2020 Standard Deductions

2020 Retirement Plan Contribution Limits & Phase-outs

2020 Estate And Gift Tax Rates & Exemptions

2020 Social Security Wage Base & Earnings Limits

Social Security Full Retirement Ages

2020 Health Savings Account Limits

2020 Education Phase Outs

2020 Alternative Minimum Tax (Amt) Exemptions, Phase Outs & Rates

Certified Financial Planner Board of Standards - 2019 Tax Tables

2019 Single Individuals Income Tax Rates

2019 Married Individuals Filing Jointly And Surviving Spouses Income Tax Rates

2019 Married Individuals Filing Separately Income Tax Rates

2019 Heads Of Households Income Tax Rates

2019 Net Investment Income Tax

2019 Additional Medicare Tax

2019 Long-term Capital Gains Rates

2019 Estates And Non-grantor Trusts Income Tax Rates

2019 Standard Deductions

2019 Retirement Plan Contribution Limits & Phase-outs

2019 Estate And Gift Tax Rates & Exemptions

2019 Social Security Wage Base & Earnings Limits

Social Security Full Retirement Ages

2019 Health Savings Account Limits

2019 Education Phase Outs

2019 Alternative Minimum Tax (Amt) Exemptions, Phase Outs & Rates

Certified Financial Planner Board of Standards - 2018 Tax Table

2018 Single Individuals Income Tax Rates

2018 Married Individuals Filing Jointly And Surviving Spouses Income Tax Rates

2018 Married Individuals Filing Separately Income Tax Rates

2018 Heads Of Households Income Tax Rates

2018 Net Investment Income Tax

2018 Additional Medicare Tax

2018 Long-term Capital Gains Rates

2018 Estates And Non-grantor Trusts Income Tax Rates

2018 Standard Deductions

2018 Retirement Plan Contribution Limits & Phase-outs

2018 Estate And Gift Tax Rates & Exemptions

2018 Social Security Wage Base & Earnings Limits

Social Security Full Retirement Ages

2018 Health Savings Account Limits

2018 Education Phase Outs

2018 Alternative Minimum Tax (Amt) Exemptions, Phase Outs & Rates

Certified Financial Planner Board of Standards - SECURE Act of 2019

Maximum Age For Traditional IRA Contributions Repealed

Portability Of Lifetime Income Options

Required Minimum Distribution Age Increased From 70½ To 72

Disclosure Regarding Lifetime Income

Expansion Of 529 Education Savings Account

Modified Required Minimum Distribution Rules

Certified Financial Planner Board of Standards - Tax Cuts And Jobs Act of 2017

Individual And Corporate Tax Rates Lowered

Standard Deductions Changes

Personal And Dependent Exemptions Repealed

State And Local Taxes (Salt) Changed

Mortgage Interest Deduction Limit. New Debt Incurred

Home Equity Loan Debt Limited To Cost Of Home

Charitable Contribution Ceiling Increased

Medical Expenses Deduction Changed

Deductions For Investment Expenses, Tax Prep Fees, And Unreimbursed Employee Expenses Are Eliminated

Personal Casualty Losses Limited

Personal Theft Loss Deduction Is Repealed

Itemized Deduction Phase-out Eliminated

Child Credit Increases. The Income Level At Which The Credit Begins To Phase Out Also Increases

Beginning With 2019, Agreements Alimony Payments Are Not Deductible By The Payer Nor Are They Taxable To The Recipient

Alternative Minimum Tax (Amt) Exemption Is Increased Allowing More Taxpayers To Avoid Amt

529 Plans Can Be Used Prior To College (K-12) For Up To $10,000

Roth IRA Re-charcterization Rules Have Changed To Eliminate Option

Investment Income Of A Child Will Be Taxed At Trust Income Tax Rates Rather Than Individual Income Tax Rates

Able Accounts Enhanced

Estate Exclusion Doubled Per Person, Effective In 2018 (Gift/Estate/Generation-skipping Transfer (Gst) Tax Exemption)

Changes To Property Depreciation Rules

Business Entertainment Expenses Eliminated

Changes To Section 1031 Like Kind Exchanges

Changes To Deductions Of Reit Dividends

20% Deduction For Qualified Business Income Of S Corporations

Tax Smart Investing 2020

The Evolving Tax Code And What It Means To You

Why Investors Are Likely Paying More Taxes Than Necessary

Most Important, The Tools Available To Fight Uncertainty And Help You Keep More Of What You Make—in Any Market Environment

The Keys to Building More Tax-efficient Portfolios

Tax-efficient Investing: It’s Not Just For The Ultra-wealthy

Strategies To Help Investors Keep More Of What They Earn

Tax Management Techniques

Choosing The Most Tax-efficient Vehicles

Implementing A Tax-managed Solution

The Future Of Tax-managed Portfolios

Build Better, More Tax-efficient Portfolios

The Power Of Diversification - Asset Class Returns From 2000-2019

Asset Class Returns: Annual Returns for Key Indices (2000-2019)

Asset Allocation Risk and Reward: Annual Returns (1958-2019)

Get to know why TAN Wealth Management partner with SEI

Who Is SEI?

SEI Private Trust Company

Some Examples Over The Last 50 Years

Corporate Clients

Monthly Market Commentary - May 2020

Global financial markets continued their sharp rallies in May amid loosening lockdowns, promising progress toward COVID-19 vaccine development, and the ongoing extraordinary support of central banks.

Legislation passed the Congress in early June that would adjust Paycheck Protection Program rules to extend the period during which companies can spend loan proceeds and remain eligible for loan forgiveness, as well as allow a lower minimum share of loan proceeds to go toward covering payroll.

We remain mindful of the known risks inherent to investing in the capital markets as well as the potential for devastating surprises such as the COVID-19 pandemic that struck in early 2020 and remains a threat today.

Quarterly Market Commentary - q1 2020

The arc of global financial markets during the first quarter corresponded with the unfolding realization that outbreak-induced shutdowns would cripple large cross-sections of the world economy.

Investors’ dash for cash created chaotic market conditions around the globe—prompting major central banks to resume global financial crisis-era policies in March, which have appeared to help markets return toward orderly function.

If your portfolio is aligned with your goals, time horizon and risk tolerance, then time and patience should be on your side. We think selling now could mean missing the rebound that will inevitably happen.

Monthly Market Commentary - February 2020

Concerns about the international spread of a novel coronavirus (COVID-19) continued to dominate financial markets throughout February.

Developed-market government bond yields tumbled as investors sought “safe-haven” assets amid equity-market volatility that crescendoed to the highest level since August 2015 (bond yields fall when their prices rise).

We maintained our emphasis on strategic (long-term) investing over tactical (short-term) decision-making, as it is impossible to identify with complete accuracy how investors might react to macroeconomic shifts.

Monthly Market Commentary - January 2020

U.S. stocks climbed through mid-January before selling off to end the month essentially flat as volatility jumped on rising concerns about the coronavirus outbreak that began in China.

The U.S. and China formalized a “phase one” trade deal that offered tariff relief to China in exchange for commitments to purchase $200 billion in U.S. products, reforms to its forced technology transfer practices, and the continued opening of its financial-services industry to foreign investors.

We retain our emphasis on strategic (long-term) investing over tactical (short-term) decision making, as it is impossible to identify with complete accuracy how investors might react to macroeconomic shifts.

Portfolio Update - Private Client Strategies Fourth Quarter 2019

Strategy Update

Investment Objective

How Did The Strategy Perform?

What Were The Main Drivers Of Performance?

Quarterly Market Commentary Fourth Quarter 2019

Equity and fixed-income markets around the globe wrapped up 2019 with above-average annual performance, giving investors the gift of optimism as they rang in the New Year.

China and the U.S. settled on a limited “phase-one” trade agreement in mid-December. The deal is expected to provide China with tariff relief and the U.S. with agricultural purchases, assurances that China will address forced technology transfer practices, and greater access to the Chinese financial services industry.

Figuring out how investors might react to shifting conditions is almost always a challenging exercise. With that in mind, as always, we retain our emphasis on long-term, strategic investing over tactical reactions to short-term events.