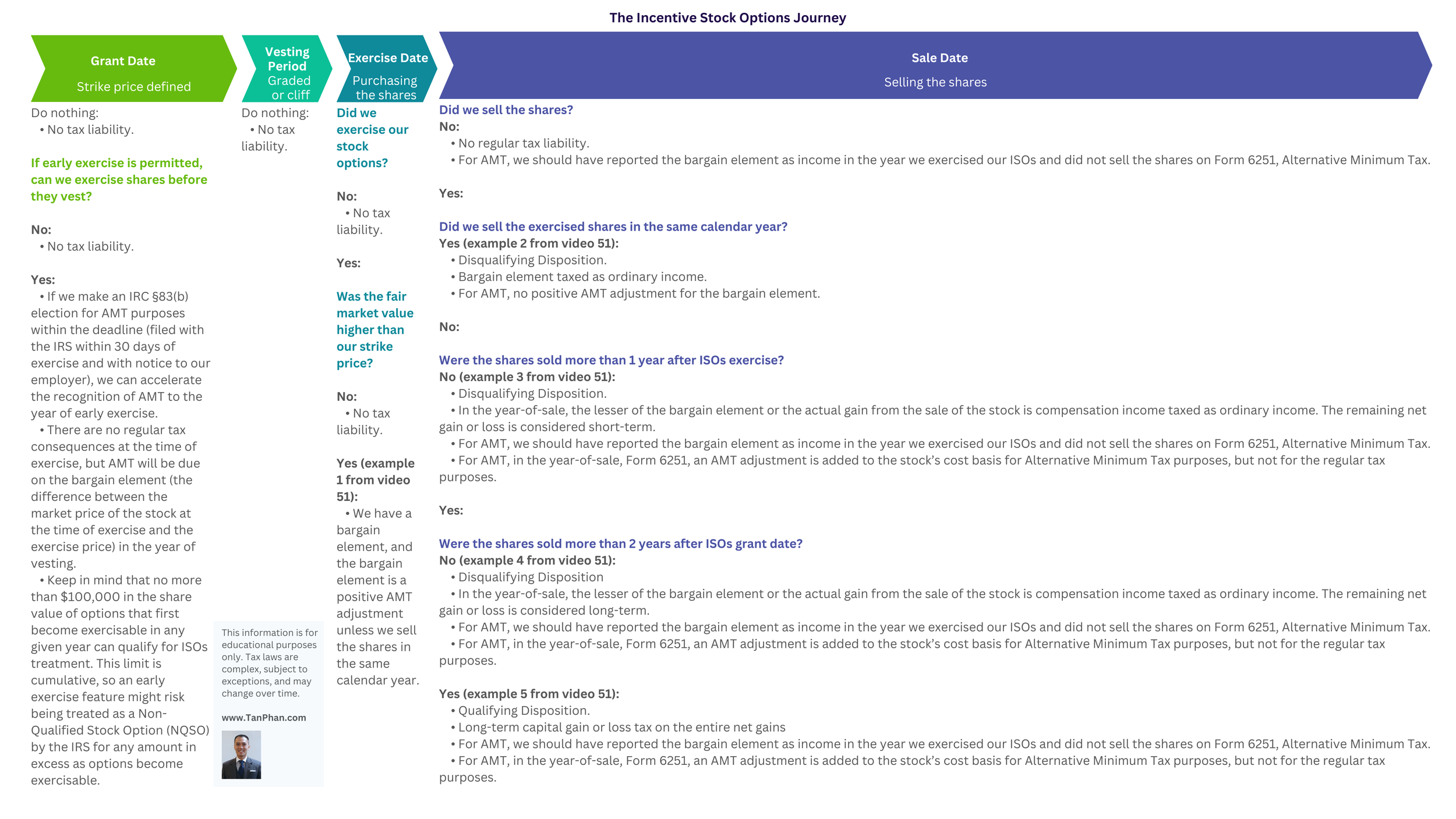

The Incentive Stock Options Journey Explained: From Grant to Sale and AMT Triggers

Hi everyone, my name is Tan, and I am an independent CERTIFIED FINANCIAL PLANNER™ practitioner at TAN Wealth Management. In this video, we explore the essential stages of our Incentive Stock Options (ISOs) journey, from the grant date through vesting, exercising, and ultimately selling our shares. We will see how each step can affect the regular tax liability and Alternative Minimum Tax (AMT) liability. By understanding these milestones—such as early exercise, 83(b) elections, and disqualifying versus qualifying dispositions—we can navigate our ISOs with greater confidence. The goal of this infographic is to provide a clear roadmap so we can make informed decisions, maximize our ISOs, and limit our tax liabilities.

Grant Date

Strike price defined.

Do nothing:

• No tax liability.

Early Exercise Option

Are we permitted to exercise by purchasing shares before they are vested?

No:

• No tax liability.

Yes:

• If we make an IRC §83(b) election for AMT purposes within the deadline (filed with the IRS within 30 days of exercise and with notice to our employer), we can accelerate the recognition of AMT to the year of early exercise.

• There are no regular tax consequences at the time of exercise, but AMT will be due on the bargain element (the difference between the market price of the stock at the time of exercise and the exercise price) in the year of vesting.

• Keep in mind that no more than $100,000 in the share value of options that first become exercisable in any given year can qualify for ISOs treatment. This limit is cumulative, so an early exercise feature might risk being treated as a Non-Qualified Stock Option (NQSO) by the IRS for any amount in excess as options become exercisable.

Vesting

Graded or cliff.

Do nothing:

• No tax liability.

Exercise

Purchase company shares.

Did we exercise our stock options?

No:

• No tax liability.

Yes:

• Was the fair market value higher than our strike price?

No:

• No tax liability.

Yes (example 1 from video 51):

• We have a bargain element, and the bargain element is a positive AMT adjustment unless we sell the shares in the same calendar year.

Sale Date

Selling the shares.

Did we sell the shares?

No:

• No regular tax liability.

• For AMT, we should have reported the bargain element as income in the year we exercised our ISOs and did not sell the shares on Form 6251, Alternative Minimum Tax.

Yes:

Did we sell the exercised shares in the same calendar year?

Yes (example 2 from video 51):

• Disqualifying Disposition.

• Bargain element taxed as ordinary income.

• For AMT, no positive AMT adjustment for the bargain element.

No:

Were the shares sold more than 1 year after ISOs exercise?

No (example 3 from video 51):

• Disqualifying Disposition.

• In the year-of-sale, the lesser of the bargain element or the actual gain from the sale of the stock is compensation income taxed as ordinary income. The remaining net gain or loss is considered short-term.

• For AMT, we should have reported the bargain element as income in the year we exercised our ISOs and did not sell the shares on Form 6251, Alternative Minimum Tax.

• For AMT, in the year-of-sale, Form 6251, an AMT adjustment is added to the stock’s cost basis for Alternative Minimum Tax purposes, but not for the regular tax purposes.

Yes:

Are the shares sold more than 2 years after ISOs grant date?

No (example 4 from video 51):

• Disqualifying Disposition

• In the year-of-sale, the lesser of the bargain element or the actual gain from the sale of the stock is compensation income taxed as ordinary income. The remaining net gain or loss is considered long-term.

• For AMT, we should have reported the bargain element as income in the year we exercised our ISOs and did not sell the shares on Form 6251, Alternative Minimum Tax.

• For AMT, in the year-of-sale, Form 6251, an AMT adjustment is added to the stock’s cost basis for Alternative Minimum Tax purposes, but not for the regular tax purposes.

Yes (example 5 from video 51):

• Qualifying Disposition.

• Long-term capital gain or loss tax on the entire net gains

• For AMT, we should have reported the bargain element as income in the year we exercised our ISOs and did not sell the shares on Form 6251, Alternative Minimum Tax.

• For AMT, in the year-of-sale, Form 6251, an AMT adjustment is added to the stock’s cost basis for Alternative Minimum Tax purposes, but not for the regular tax purposes.

Insights:

• A company’s fair market value is determined by the 409A valuation while it remains private and by the current stock price once it becomes public.

• When we exercise our ISOs and choose not to sell the shares within the same calendar year, we incur an AMT positive adjustment for that year.

• An AMT adjustment could trigger AMT liability. For the Alternative Minimum Tax purposes, but not for the regular tax purposes. The net gain or loss minus the cost basis. The cost basis is the actual price paid per share times the number of shares plus the AMT adjustment from the year-of-exercise.

• The exercise cost includes the exercise price plus any applicable fees.

• This information is for educational purposes only. Tax laws are complex, subject to exceptions, and may change over time.

• If you have any suggestions or adjustments for this infographic, I’d love to hear from you! Feel free to email me at tan@tanphan.com