Tax Guide and Resources for 2024

Hi everyone, my name is Tan, and I am an independent CERTIFIED FINANCIAL PLANNER™ practitioner at TAN Wealth Management. For today’s educational video, we are going to talk about the tax guide and resources for the 2024 tax year. Please note that the information is for educational use only and is subject to change.

What are taxes?

Taxes refer to the funds collected by the government to support its operations, such as public services, healthcare, pensions and social security, social programs, environmental programs, law enforcement and judiciary, infrastructure development, research and development, defense and national security, and debt repayment. Taxes play a crucial role in maintaining a functional society and contribute to the well-being and prosperity of its citizens. Americans contribute to various types of taxes, including income taxes, capital gains taxes, property taxes, sales taxes, estate taxes, etc. Taxes can promote income distribution, that’s why the average high-income earners pay more in taxes than the average low-income earners.

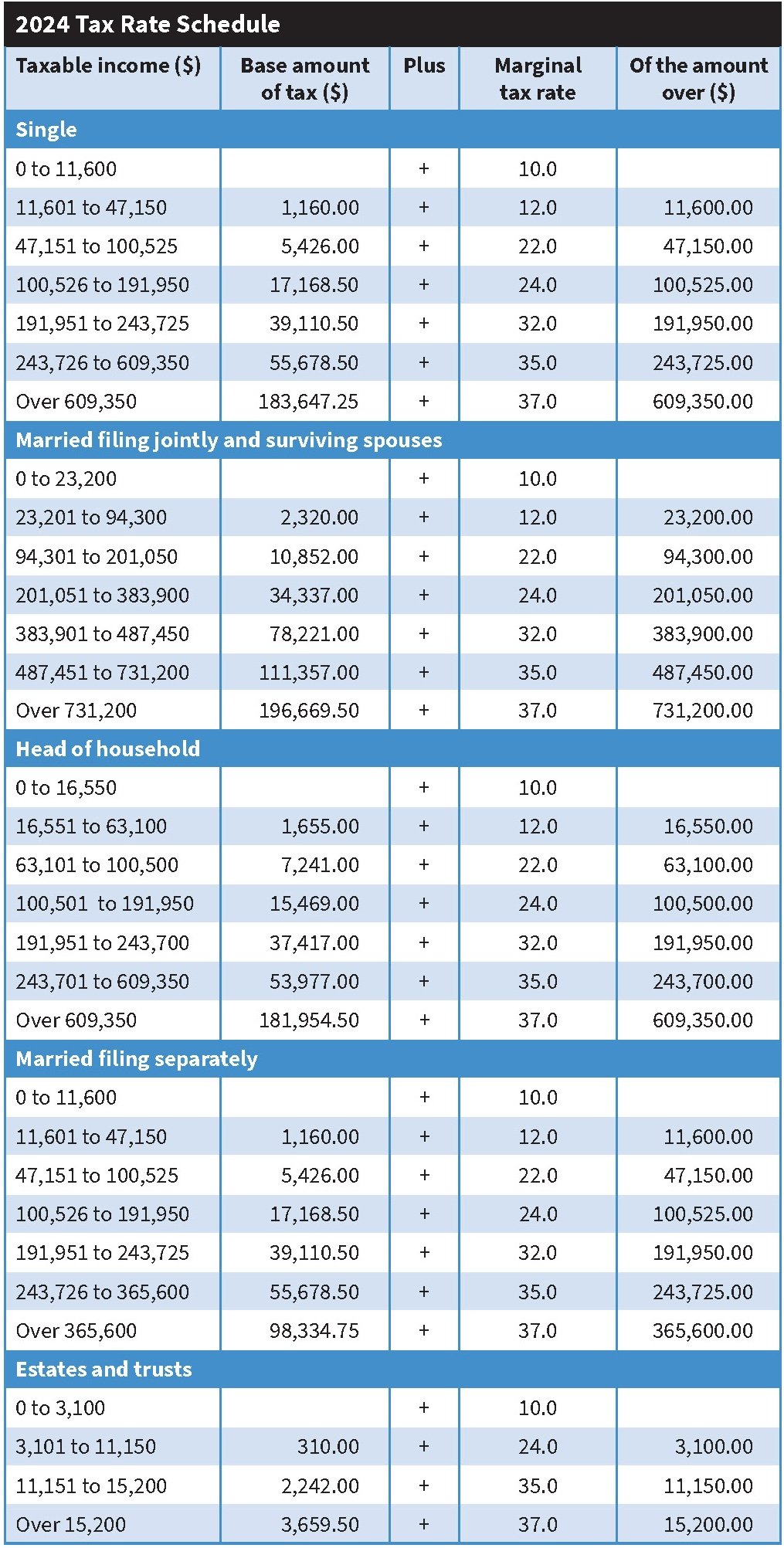

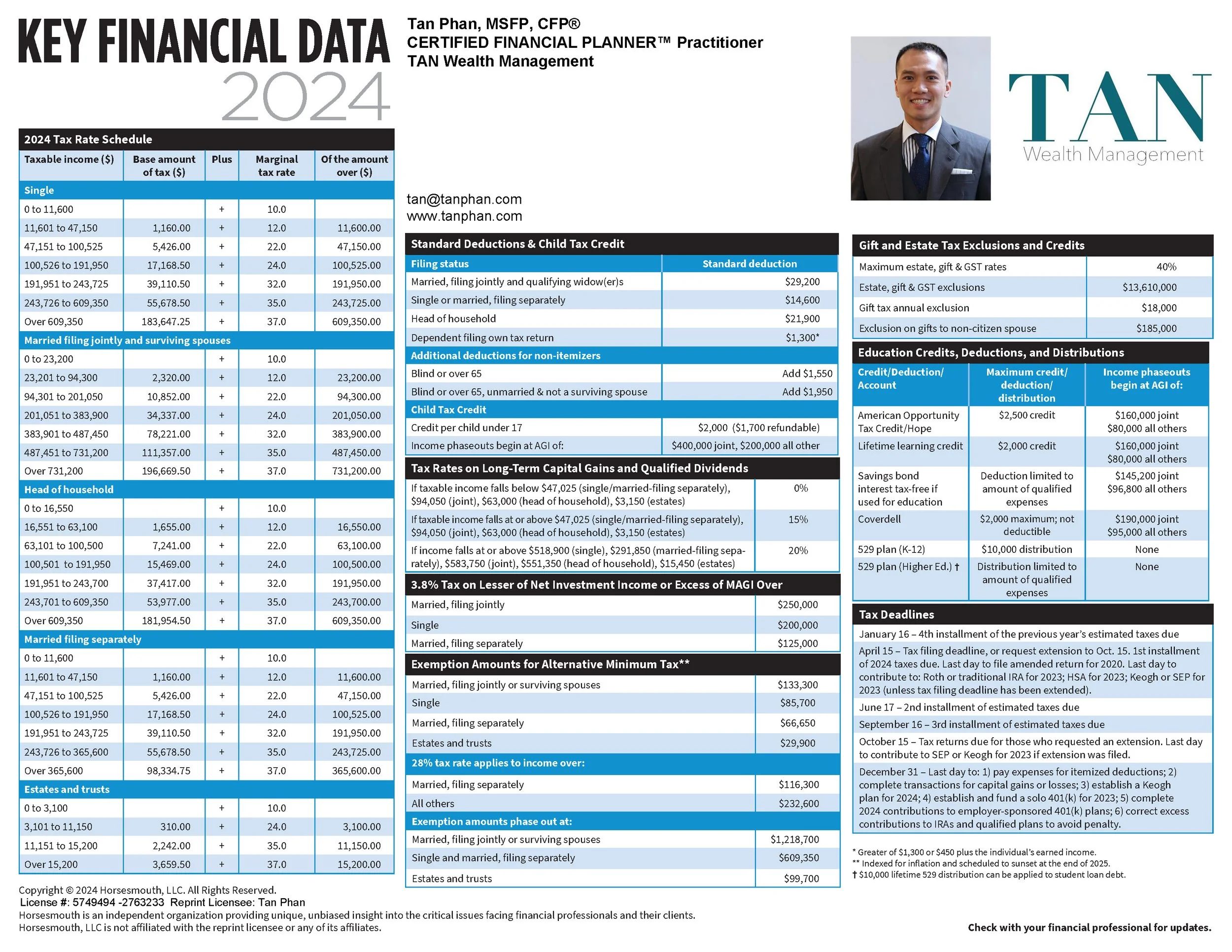

2024 Tax Rate Schedule

There are seven tax brackets for the 2024 tax year for filing status single, married filing jointly and surviving spouses, head of household, and married filing separately. There are four tax brackets for the 2024 tax year for estate and trusts.

What is a tax bracket? A tax bracket is a range of income where a specific tax rate applies. Each bracket corresponds to a tax rate where the income falls in that bracket is taxed at that specific tax rate.

Marginal tax rate vs effective tax rate.

What is a marginal tax rate? A marginal tax rate is a percentage of tax applied to the last dollar of income earned. Look at the Federal tax bracket table, what is your taxable income, where does your taxable income fall under, that’s your marginal tax rate. What is an effective tax rate? An effective tax rate (average tax rate) is a total tax paid divided by total income earned. It is the actual percentage we pay on our taxes. Not all of our income will be taxed at the higher tax rate because we are in a progressive tax system, where tax rates increase as our income rises. Each portion of our income is taxed at the rate applicable to its respective tax bracket. Again, the marginal tax rate focuses on the tax rate applied to the last dollar of income in a particular tax bracket, while the effective tax rate provides a comprehensive view of the average tax rate on all income after considering tax deductions and tax credits.

For single filing status, the first $11,600 is taxed at the 10% tax rate. $11,600 X 10% = $1,160. That’s where the base amount of tax of $1,160 in the tax table comes from.

For taxable income from $11,601 to $47,150, it’s taxed at the 12% tax rate.

$47,150 - $11,601 = $35,549

$35,549 X 12% ≈ $4,266

$4,266 + $1,160 ≈ $5,426.

That’s where the base amount of tax of $5,426 in the tax table comes from.

If our taxable income is $100,000 and we are single filers.

$100,000 - $47,151 = $52,849

$52,849 X 22% ≈ $11,627

$11,627 + $5,426 ≈ $17,053

$17,053 is the Federal tax. Our marginal tax rate is the rate the last dollar is taxed which is 22% from our example. Our effective tax rate which is our average tax rate is 17%. Our tax of $17,053 divided by our taxable income of $100,000 equals 17%.

The reason for the change in the income range in the tax bracket is to avoid bracket creep which is when inflation pushes us into higher tax brackets. If everything is the same, if the taxable income range increases in the brackets, we will pay less in taxes. If the taxable income range decreases in the brackets, we will pay more in taxes because more of our taxable income is subjected to the higher tax rates. For example, let’s compare the taxable income at the 35% tax rate in the 2020 tax year with the 2024 tax year. For 2020, for income over $207,350, it’s taxed at 35%. For 2024, for income over $243,725, it’s taxed at 35%. If our taxable income is $500,000, we will pay more in taxes in 2020 compared to 2024 because more of our income applies to the 35% tax rate.

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2020

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2024

With the estates and trusts tax rate for the 2024 tax year, we could be at the 37% tax rate when taxable income is above $15,200. By comparison, the tax rate for single filers on taxable income between $11,601 to $47,150 is 12%. To reach the 37% tax rate for single filers, taxable income needs to be over $609,350. We want to keep this in mind when we are structuring and handling trusts. Be careful with naming a trust as a beneficiary on our assets because it might not work as intended. I say be careful because we really have to know how the money flows from us to the trust to the beneficiary and how it’s taxed. When we know how the money flows and how it’s taxed, naming a trust as a beneficiary on certain assets is a great arrangement in an estate plan.

Standard Deductions & Child Tax Credit

What is a standard deduction? A standard deduction is a fixed dollar amount normally adjusted for inflation, that reduces the income on which we are taxed. We subtract the standard deduction from our adjusted gross income (AGI) which is on Form 1040, line 11, to reduce our taxable income. It is a simpler method to decrease our taxable income without the requirement to maintain detailed records of various deductible expenses. The standard deduction amount is determined by the tax filing status. The filing status for married filing jointly and qualifying window(er)s, the standard deduction is $29,000. Single or married filing separately is $14,600. Head of household is $21,900. Dependent filing own tax return is $1,300 (greater of $1,300 or $450 plus the individual’s earned income). This is directly from the IRS website, “if you can be claimed as a dependent on another person's 2024 return, your standard deduction is the greater of $1,300, or your earned income plus $450 (up to the standard deduction amount).”

https://www.irs.gov/pub/irs-pdf/f1040es.pdf

“In general, a dependent should file if their earned income exceeds the standard deduction for singles or if their investment income exceeds…$1,300 for 2024. You should file a return if you had taxes withheld from your pay in any amount…”

https://www.efile.com/how-does-a-dependent-file-an-irs-income-tax-return

There are additional deductions for non-itemizers. People who are blind or over age 65 (married taxpayers or qualifying surviving spouse) receive an extra deduction of $1,550 each in 2024. People who are blind or over age 65, unmarried and not a surviving spouse (single or head of household) receive an extra deduction of $1,950 each in 2024.

These numbers are for taxpayers who want to take the standard deduction. We have the option to take the standard deduction or the itemized deduction (from Schedule A) which is on Form 1040, line 12. Our goal is to reduce our taxable income by choosing the option (standard deduction or itemized deductions) that gives us the greater reduction.

https://www.irs.gov/pub/irs-pdf/f1040.pdf

“Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.”

https://www.irs.gov/forms-pubs/about-schedule-a-form-1040

What are itemized deductions? Itemized deductions are certain taxes, interest, contributions, and expenses we can subtract from our adjusted gross income (AGI) which is on Form 1040, line 11, to reduce our taxable income.

In contrast to taking the standard deduction, we can take the itemized deductions which require us to list and provide evidence of qualifying expenses. It’s very important for us to keep records and I like to keep records at two different places. Some common itemized deductions are qualified medical expenses, state and local taxes (SALT), mortgage interest, charitable contributions to qualifying charitable organizations, casualty and theft losses not reimbursed by insurance, job expenses and miscellaneous deductions, such as job-search costs, professional dues, and certain educational expenses. It's important to note that some expenses may have limitations or specific criteria for eligibility.

The four major itemized deductions are:

• State and local taxes (SALT), limited to $10,000. “State, Local, and Foreign Income Taxes or State and Local General Sales Taxes…As an individual, your deduction of state and local income, general sales, and property taxes is limited to a combined total deduction of $10,000 ($5,000 if married filing separately). You may be subject to a limit on some of your other itemized deductions also. Please refer to the Instructions for Schedule A (Form 1040) and Topic No. 501 for the limitations.”

https://www.irs.gov/taxtopics/tc503

• “Home mortgage interest. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($500,000 if married filing separately)) apply if you are deducting mortgage interest from indebtedness incurred before December 16, 2017.

https://www.irs.gov/publications/p936

• Unreimbursed medical expenses. “If you itemize your deductions for a taxable year on Schedule A (Form 1040), Itemized Deductions, you may be able to deduct the medical and dental expenses you paid for yourself, your spouse, and your dependents during the taxable year to the extent these expenses exceed 7.5% of your adjusted gross income for the year. The deduction applies only to expenses not compensated by insurance or otherwise regardless of whether you receive the reimbursement directly or payment is made on your behalf to the doctor, hospital, or other medical provider.”

https://www.irs.gov/taxtopics/tc502

• Charitable contributions, donor-advised funds are pretty popular because we can give a lot at once to increase our donation and have the account distribute the money to the charities overtime. In regards to giving to charities, we want to give to charities because we want to, not because of the tax benefit. The tax benefit is a secondary benefit. What is a donor-advised fund? “Generally, a donor advised fund is a separately identified fund or account that is maintained and operated by a section 501(c)(3) organization, which is called a sponsoring organization. Each account is composed of contributions made by individual donors. Once the donor makes the contribution, the organization has legal control over it. However, the donor, or the donor's representative, retains advisory privileges with respect to the distribution of funds and the investment of assets in the account.”

https://www.irs.gov/charities-non-profits/charitable-organizations/donor-advised-funds

Let’s talk about the bunching strategy.

What is the bunching strategy? The bunching strategy is taking the standard deduction in one year, and then accumulate deductible expenses to itemize for the next year. We can take the standard deduction every other year or every two, three, or four years depending on our strategy. Here is an example of what the bunching strategy can look like. Instead of taking the standard deduction annually because our standard deduction is higher than our itemized deductions, we can accumulate our deductible expenses and take the standard deduction in year 1 and year 3 and itemized deductions in year 2 and year 4. This will maximize our deductions and decrease our taxable income.

For example, the standard deduction in year 1 and year 2 is $18,000. Itemized Ace and Bunching Rex. Ace and Rex both have $20,000 in deductions which includes charitable contributions of $6,000 in year 1 and $6,000 in year 2. Ace takes the itemized deduction of $20,000 in year 1 and $20,000 in year 2 because his itemized deduction of $20,000 is higher than the standard deduction of $18,000. Ace total deduction is $40,000 ($20,000 + $20,000). Rex bunches the charitable contribution of $6,000 in year 1 and $6,000 year 2 into year 1 which results in a total of $12,000 of charitable contribution. The total itemized deduction is $26,000 ($20,000 + $6,000) for year 1 so Rex will take the itemized deduction in year 1. Because Rex itemized deduction is $14,000 in year 2 ($20,000 - $6,000), Rex will take the standard deduction of $18,000. Rex total deduction is $44,000 ($26,000 + $18,000). Thus, Rex’s total tax liability is lower than Ace’s total tax liability because Rex has a higher total deduction.

Let’s look at another example. The standard deduction in year 1 and year 2 is $18,000. Standard Luna and Bunching Rex. Luna and Rex both have $16,000 in deductions which includes charitable contributions of $6,000 in year 1 and $6,000 in year 2. Luna takes the standard deduction of $18,000 in year 1 and $18,000 in year 2 because her standard deduction of $18,000 is higher than her itemized deduction of $15,000. Luna total deduction is $36,000 ($18,000 + $18,000). Rex bunches the charitable contribution of $6,000 in year 1 and $6,000 year 2 into year 1 which results in a total of $12,000 of charitable contribution. The total itemized deduction is $22,000 ($16,000 + $6,000) for year 1 so Rex will take the itemized deduction in year 1. Because Rex itemized deduction is $10,000 in year 2 ($16,000 - $6,000), Rex will take the standard deduction of $18,000. Rex total deduction is $40,000 ($22,000 + $18,000). Thus, Rex’s total tax liability is lower than Luna’s total tax liability because Rex has a higher total deduction.

Child tax credit.

The 2024 child tax credit is worth up to $2,000 per qualifying child under age 17 and up to $1,700 of that amount is refundable. Income phaseout begins at adjusted gross income (AGI) of $400,000 for joint tax filers and $200,000 for all other tax filing statuses.

What is an income phaseout pertaining to a tax credit? An income phaseout is a gradual reduction of a tax credit after our income reaches the limit. The $2,000 credit per child is the maximum. The credit will be lower based on our adjusted gross income.

What is a child tax credit? A child tax credit is a tax benefit that provides qualifying taxpayers a credit for each qualifying child. The credit is designed to help families with the cost of raising children.

What is a tax credit? “A tax credit is a dollar-for-dollar amount taxpayers claim on their tax return to reduce the income tax they owe. Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund.”

https://www.irs.gov/newsroom/tax-credits-for-individuals-what-they-mean-and-how-they-can-help-refunds

What is the difference between a refundable tax credit and a nonrefundable tax credit?

• Refundable tax credits and non-refundable tax credits are two types of tax credits that can help reduce taxable income. We benefit more from refundable tax credits because they provide a potential for a cash refund.

• A refundable tax credit can reduce taxable income. When our tax liability is zero and there are remaining credits, the amount will be given to us. “A refundable tax credit is a credit you can get as a refund even if you don't owe any tax. Tax credits are amounts you subtract from your bottom-line tax due when you file your tax return. Most tax credits can reduce your tax only until it reaches $0. Refundable credits go beyond that to give you any remaining credit as a refund. That's why it's best to file taxes even if you don't have to. Many people who qualify for refundable credits miss out on refunds because they don't file.” Examples of refundable tax credits are the Child Tax Credit (partially refundable), American Opportunity Tax Credit (partially refundable), and Earned Income Tax Credit (EITC).

https://www.irs.gov/credits-deductions/refundable-tax-credits

• Nonrefundable tax credits can only reduce our tax liability to zero. We do not get any leftover amount back as a refund. Any excess credit beyond zero tax liability is lost. Examples of nonrefundable tax credits are the Clean Vehicle Tax Credits. “The credit is nonrefundable, so you can't get back more on the credit than you owe in taxes. You can't apply any excess credit to future tax years.”

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles-purchased-in-2023-or-after

Here is an example of a refundable versus nonrefundable tax credit.

• Refundable tax credit. We have a $1,000 tax liability, we claimed a $3,000 refundable tax credit, the $3,000 offset the $1,000 tax liability and we get a check for $2,000.

• Nonrefundable tax credit. We have a $1,000 tax liability, we claimed a $3,000 nonfundable tax credit, the $3,000 offset the $1,000 tax liability and we do not get a check for the excess amount of $2,000 because the nonrefundable tax credit will only offset up to our tax liability.

What is my modified adjusted gross income (AGI)?

“For purposes of the Child Tax Credit and advance Child Tax Credit payments, your modified AGI is your adjusted gross income (from the 2020 IRS Form 1040, line 11, or, if you haven’t filed a 2020 return, the 2019 IRS Form 1040, line 8b), plus the following amounts that may apply to you.

• Any amount on line 45 or line 50 of the 2020 or 2019 IRS Form 2555, Foreign Earned Income.

• Any amount excluded from gross income because it was received from sources in Puerto Rico or American Samoa.

If you do not have any of the above, your modified AGI is the same as your AGI.”

https://www.irs.gov/credits-deductions/2021-child-tax-credit-and-advance-child-tax-credit-payments-topic-c-calculation-of-the-2021-child-tax-credit

To qualify for the child tax credit the “dependent generally must:

• Be under age 17 at the end of the year

• Be your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of one of these (for example, a grandchild, niece or nephew)

• Provide no more than half of their own financial support during the year

• Have lived with you for more than half the year

• Be properly claimed as your dependent on your tax return

• Not file a joint return with their spouse for the tax year or file it only to claim a refund of withheld income tax or estimated tax paid

• Have been a U.S. citizen, U.S. national or U.S. resident alien

You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000 ($400,000 if filing a joint return).

Parents and guardians with higher incomes may be eligible to claim a partial credit.”

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

Tax Rates on Long-Term Capital Gains and Qualified Dividends

There are three tax brackets in long-term capital gains and qualifying dividends. 0%, 15%, and 20%. Let’s look at the long-term capital gains tax rate of 20%, our income needs to be at or above $518,900 for single filers while only at or above $15,450.

How are long-term capital gains taxed?

Net long-term capital gains are taxed at graduated tax rates. “Net capital gains are taxed at different rates depending on overall taxable income, although some or all net capital gain may be taxed at 0%. For taxable years beginning in 2023, the tax rate on most net capital gain is no higher than 15% for most individuals.

A capital gains rate of 0% applies if your taxable income is less than or equal to:

• $44,625 for single and married filing separately;

• $89,250 for married filing jointly and qualifying surviving spouse; and

• $59,750 for head of household.

A capital gains rate of 15% applies if your taxable income is:

• more than $44,625 but less than or equal to $492,300 for single;

• more than $44,625 but less than or equal to $276,900 for married filing separately;

• more than $89,250 but less than or equal to $553,850 for married filing jointly and qualifying surviving spouse; and

• more than $59,750 but less than or equal to $523,050 for head of household.

However, a capital gains rate of 20% applies to the extent that your taxable income exceeds the thresholds set for the 15% capital gain rate.

There are a few other exceptions where capital gains may be taxed at rates greater than 20%:

1. The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate.

2. Net capital gains from selling collectibles (such as coins or art) are taxed at a maximum 28% rate.

3. The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25% rate.

Note: Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates.”

https://www.irs.gov/taxtopics/tc409

This means net long-term capital gains are taxed at graduated tax rates. Based on the above information, if we are single and we have $500,000 in net long-term capital gains, we will be subjected to all three capital gains tax rates. 0% for the first $44,625, 15% from $44,625 to $492,300, and 20% from $492,301 to $500,000.

Long-term capital gains vs short-term capital gains

• Long-term capital gains are taxed at long-term capital gains tax rates. With long-term capital losses, the losses can offset long-term capital gains, short-term capital gains, $3,000 off ($1,500 if married filing separately) of our ordinary income, and then remaining losses carry forward to next year.

• Short-term capital gains are taxed at ordinary income tax rates. With short-term capital losses, the losses offset short-term capital gains, long-term capital gains, $3,000 off ($1,500 if married filing separately) of our ordinary income, then remaining losses carry forward to next year.

• Remember, to get long-term capital gains or losses tax treatments, we need to hold the investment for more than a year, which is more than 365 days. If we hold the investment for 365 days or less, it’s considered a short-term capital gain or loss. Capital gains tax rates are lower than ordinary income tax rates.

Qualified dividends vs non-qualified dividends

• Qualified dividends are taxed at capital gains tax rates.

• Non-qualified or “ordinary” dividends are taxed at ordinary income tax rates.

• “For dividends to fall in the qualified dividend category, they typically must be paid by a U.S. corporation or a qualifying foreign corporation. Generally, you must also meet the holding period requirement. The holding period for most types of qualified dividends requires you to have held the investment unhedged for more than 60 days during the 121-day period that starts 60 days prior to the ex-dividend date. An ex-dividend date is typically one day before the "date of record" or "record date." If you purchase a dividend generating investment on its ex-dividend date or after, you typically will not receive the next dividend payment. Generally, the holding period doesn't include the day you purchased an investment, but it does include the day you sold it.“

https://turbotax.intuit.com/tax-tips/investments-and-taxes/guide-to-taxes-on-dividends/L1jBC5OvB

• The financial institution normally specifies which dividends are qualified and non-qualified on Form 1099-DIV. Total ordinary dividends are on box 1a and qualified dividends are on box 1b.

https://www.irs.gov/pub/irs-pdf/f1099div.pdf

3.8% Tax on Lesser of Net Investment Income or Excess of MAGI Over

What is the 3.8% Net Investment Income Tax (NIIT)?

The Net Investment Income Tax was created as part of the Affordable Care Act in 2013 to raise revenue for Medicare. That’s why it’s also called the Unearned Income Medicare Contribution Surtax (UIMCS). The Net Investment Income Tax is enforced by Section 1411 of the Internal Revenue Code. The 3.8% Net Investment Income Tax applies on the lesser of the taxpayer’s net investment income or the amount that exceeds the taxpayer’s modified adjusted gross income (MAGI). The Net Investment Income Tax “applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts.”

https://www.irs.gov/newsroom/questions-and-answers-on-the-net-investment-income-tax

“What individuals are subject to the Net Investment Income Tax?

Individuals will pay the 3.8% tax “if they have net investment income and also have modified adjusted gross income (MAGI) over the following thresholds:”

• $250,000 of MAGI for married filing jointly,

• $125,000 of MAGI for married filing separately,

• $200,000 of MAGI for single,

• $200,000 of MAGI for head of household (with qualifying person),

• $250,000 of MAGI for qualifying widow(er) with dependent child.

• Taxpayers should be aware that these threshold amounts are not indexed for inflation.”

https://www.irs.gov/newsroom/questions-and-answers-on-the-net-investment-income-tax

“In addition, trusts, like individuals, may be subject to the net investment income tax (NIIT) for any undistributed investment income. This is a 3.8% tax on either the trust’s undistributed net investment income, or the excess of adjusted gross income over $14,450 [$15,200 for 2024 tax year], whichever is less. In comparison, a single individual is subject to the NIIT on the lesser of net investment income, or excess modified adjusted gross income over $200,000.”

https://www.fidelity.com/viewpoints/wealth-management/insights/trusts-and-taxes

The 3.8% tax is on the lesser of the net investment income or the excess of modified adjusted gross income over the threshold amount. I am seeing more clients being subjected to the 3.8% net investment income tax because with the current law, the thresholds are not indexed for inflation. Here is an educational video on what is the 3.8% Net Investment Income Tax (NIIT), what individuals are subject to the NIIT, what is included in the NIIT, examples of the NIIT, how can we avoid the 3.8% NIIT, and more.

https://tanphan.com/blog/what-is-the-38-net-investment-income-tax-niit

Exemption Amounts for Alternative Minimum Tax**

What is the alternative minimum tax (AMT)?

The alternative minimum tax is a parallel tax system from the regular federal income tax. When you input your data into the tax software, the tax software runs your tax liability on the regular federal income tax table and the alternative minimum tax table. Your tax liability will be the higher of the two tax tables. For example, if the tax software says you owe $50,000 on the regular federal income tax table and $40,000 on the alternative minimum tax table, your total tax liability is $50,000. If the tax software says you owe $50,000 on the regular federal income tax table and $70,000 on the alternative minimum tax table, your total tax liability is $70,000. Regular federal income tax liabilities of $50,000 + (AMT liabilities of $70,000 - regular federal income tax liabilities of $50,000) = $70,000. Technically, that is how we calculate the total tax liability, but for simplicity, it’s easier to understand when we say we paid the total tax liability of the higher two tax tables. Thus, alternative minimum tax only applies when our alternative minimum tax liability exceeds our regular federal income tax liability. With the current law, most households are not subject to AMT because of the large AMT exemption.

What is an alternative minimum tax exemption?

An alternative minimum tax (AMT) exemption is an alternative minimum tax income (AMTI) offset. For example, if you are single and your AMTI is $70,000 and the AMT exemption for single taxpayers is $85,700 for 2024. You do not have an AMT liability because $70,000 minus $85,700 is a negative number. If your AMTI is $90,000. $90,000 minus $85,700 equals $4,300. $4,300 is your minimum tax base then you multiply $4,300 by the AMT rate to get the tentative AMT liability. Although you are subject to AMT, it doesn’t mean you have to pay AMT liability because you have to pay the higher amount of the regular income tax liability or the AMT liability. AMT is a parallel tax system of the regular federal income tax. If you owe $100,000 under the regular federal income tax and $120,000 under AMT, you pay $100,000 for regular income tax, and the $20,000 is for the AMT. Thanks to Congress, the AMT exemption amounts are automatically adjusted with inflation.

The 2024 AMT exemption amounts are:

• Married filing jointly or surviving spouse is $133,300

• Single is $85,700

• Married filing separately is $66,650

• Estates and trusts is $29,900

28% tax rate applies to income over $116,300 for married individuals filing separate returns and $232,600 for all others, such as joint returns, unmarried individuals (other than surviving spouses), and estates and trusts. Income below these figures is taxed at the 26% tax rate. Alternative minimum tax rates are progressive, which means we will be taxed at the 26% tax rate, and then the 28% tax rate on the amount exceeds the annual limit.

In general, what does “phaseout” mean?

Every year, the IRS publishes phaseout. When our modified adjusted gross income (MAGI) or adjusted gross income (AGI) exceeds a certain phaseout, the tax deductions or tax credits get reduced until we get no tax deductions or tax credits.

The 2024 AMT exemption begins to phase out at:

• Married filing jointly or surviving spouse is $1,218,700

• Single and married filing separately is $609,350

• Estates and trusts is $99,700

25 cents disappear from our exemption for every one dollar above the phaseout. I like to teach by providing examples so let’s look at a single taxpayer. For 2024, Luna is a single taxpayer. The AMT exemption is $85,700 and it begins to phase out at $609,350. She has an alternative minimum tax income of $700,000 for 2024. This example will give Luna some AMT exemption but not all.

$700,000 - $609,350 = $90,650.

$90,650 / 4 = $22,663.

$22,663 - AMT exemption of $85,700 = AMT exemption of $63,037.

AMTI of $700,000 - AMT exemption of $63,037 = Minimum tax base of $636,963.

Why we should not go over the annual alternative minimum tax income phaseout amount? The alternative minimum tax exemption can be reduced to zero for high-income earners. Let’s do another example by assuming Luna has an alternative minimum tax income of $900,000 for 2024.

$1,000,000 - $609,350 = $390,650.

$390,650 / 4 = $97,663.

$97,663 - AMT exemption of $73,600 = AMT exemption of $0.

We deduct Luna’s AMTI of $1,000,000 from $609,350 because that is the amount the phaseout begins. We divided by 4 because 25 cents disappear for every one dollar above the phaseout. Thus, Lune will not receive an AMT exemption because her alternative minimum tax income is too high. She is completely phased out. Let’s take it another step further by adding the tax rates to get the tentative AMT liability.

$232,600 X 26% = $60,476.

($1,000,000 - $232,600) X 28% = $214,872.

$60,476 + $214,872 = $275,348.

$275,348 is the tentative AMT liability.

It’s nice to see how the AMT exemption amounts, phase out, and tax rate work together. You can learn more on alternative minimum tax (AMT) in this educational video.

https://tanphan.com/blog/what-is-alternative-minimum-tax-amt

Gift and Estate Tax Exclusions and Credits

The maximum estate, gift, and generation skipping tax (GST) is 40%. That is the maximum rate. Estate tax is progressive and GST tax is a flat rate of 40%.

“The individual and corporate income taxes and the estate tax are all progressive.”

https://www.taxpolicycenter.org/briefing-book/are-federal-taxes-progressive

“The GST tax is separate from, and in addition to, the estate tax. The tax is currently calculated at a flat rate of 40% (equal to the estate and gift tax rate) on transfers above the lifetime GST tax exemption amount ($13.61 million per individual in 2024).”

https://www.usbank.com/wealth-management/financial-perspectives/trust-and-estate-planning/generation-skipping-tax-affect-on-estate-plan.html

The lifetime gift tax exemption and generation-skipping transfer (GST) tax exemption is $13,610,000. This is the lifetime exclusion amount. The tax is on the exceeded amount and not the entire value of the estate. Any amount above the exclusion could be taxable. I say could because we have to go through the tax return to know if we have a tax liability above the exclusion amount. You can learn more by visting the IRS website under Instructions for Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return.

https://www.irs.gov/instructions/i706

A common question I get is what happens if the estate tax exemption in 2026 reset to $5 million, adjusted for inflation? According to the IRS, “how does the basic exclusion amount apply in 2026 if I make large gifts before 2026? Individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels.”

https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-estate-taxes

Married individuals should also be aware of transfering unsed exclusion amount to the surviving spouse. “How do I elect portability of the Deceased Spousal Unused Exclusion (DSUE) amount to benefit the surviving spouse? In order to elect portability of the decedent's unused exclusion amount (deceased spousal unused exclusion (DSUE) amount) for the benefit of the surviving spouse, the estate's representative must file an estate tax return (Form 706) and the return must be filed timely. The due date of the estate tax return is nine months after the decedent's date of death, however, the estate's representative may request an extension of time to file the return for up to six months. An automatic six month extension of time to file the return is available to all estates, including those filing solely to elect portability, by filing Form 4768 on or before the due date of the estate tax return.”

https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-estate-taxes

The annual gift tax exclusion per donee is $18,000 for 2024. For married individuals, they can give $34,000 total ($18,000 + $18,000) to an individual. Normally, the giver (donor) is responsible for the tax, not the receiver (donee). The annual gift tax exclusion is use it or lose it. We can use it from January 1st to December 31st. Amount gift exceed the annual exclusion are deducted from the lifetime gift tax exclusion. The lifetime gift tax exemption and generation-skipping transfer (GST) tax exemption can be carry forward into future years until it’s exhausted. We use Form 709 to keep track of our lifetime exclusion amount.

“If your spouse is not a U.S. citizen, the marital deduction for gifts is limited to an annual exclusion of…$185,000 for 2024. See IRC § 2523(i).”

https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes-for-nonresidents-not-citizens-of-the-united-states

Pro tips:

• We could make annual gift tax to decrease the taxable estate.

• We could also do Roth conversion from pre-tax accounts to Roth accounts during your lifetime if the math make sense. This will decrease our gross estate and qualified distributions are tax-free.

• Skipping generations. Grandparents skip a generation or two and give special gifts to their grandchildren and great-grandchildren when they are born. The gifts can cover things like diapers and preschool costs to more long-term, like saving for college using 529 plans or setting up special trusts. This helps save money on taxes. When planning what to leave behind, it's important to decide when we want our heirs to get the gifts and how much control do we want over how they use the money.

• The federal estate tax exemption to “sunset” at the End of 2025. Depending on the clients, I am suggesting some clients to contribute to 529 plans for their grandchildren. The money is out of their estate and they still have control of the money. Gifting to family members up to the annual gift tax exclusion is also popular. I am monitoring the estate tax exclusions. For the ultra high net worth families and individuals, there are strategies we can implement if the estate tax exclusion were to sunset to $5 million, adjusted for inflation, which is approximately $7 million in 2026. Some notable strategies are properly structuring irrevocable life insurance trust (ILIT), grantor retained annuity trust (GRAT), grantor retained interest trust (GRIT), and grantor retained unitrust (GRUT).

• “It is better to give with a warm hand than with a cold one!” When you have more than enough money to live during your lifetime, it’s better to gift when you are living so you can see the benefit of the gifts rather than making those gifts after you are deceased.

Education Credits, Deductions, and Distributions

What is a tax credit?

With a tax credit, it can be refundable or non-refundable.

• ”Some tax credits are refundable. If a taxpayer's tax bill is less than the amount of a refundable credit, they can get the difference back in their refund. Some taxpayers who aren't required to file may still want to do so to claim refundable tax credits. Not all tax credits are refundable, however. For nonrefundable tax credits, once a taxpayer's liability is zero, the taxpayer won't get any leftover amount back as a refund.”

https://www.irs.gov/newsroom/tax-credits-for-individuals-what-they-mean-and-how-they-can-help-refunds

• Tax credit is better than a tax deduction because it’s a dollar-for-dollar tax liability offset

What is a tax deduction?

A tax deduction is an expense that we can subtract from our total income before calculating the amount of income that is subject to taxation. Lower taxable income equals lower income taxes. Notable tax deductions are certain business expenses, benefits plans (such as 401(k) plans, health saving accounts, and others), deductible contributions to Traditional IRAs, property taxes, mortgage interest, charitable contributions, and unreimbursed medical expenses. It's important to keep records of our expenses when we claim tax deductions on our tax returns.

The maximum credit for the American Opportunity Tax Credit is $2,500 and lifetime learning credit is $2,000. The savings bond interest is tax deductible to the amount used for qualified education expenses.

With Coverdell education savings accounts (ESAs), the maximum contribution limit is $2,000 per child per year regardless how many accounts are for that child and how many people contribute to that child. The $2,000 maximum contribution limit is an overall limit on contributions per child. We cannot deduct the contribution amount, that’s why we see on the table it says “not deductible”. The tax benefit is the earnings in the account are tax-free when used to pay for qualified education expenses. “Contributions must be made in cash, and they're not deductible…There's no limit to the number of accounts that can be established for a particular beneficiary; however, the total contribution to all accounts on behalf of a beneficiary in any year can't exceed $2,000.” No income phaseout on the contributions or distributions.

https://www.irs.gov/taxtopics/tc310

This key financial data is at the federal level. There is no tax deduction on the contribution to a 529 plan at the federal level. The tax deduction on contributions varies by states. Some states offer a tax deduction on contribution and we can use any 529 plans. Some states offer a tax deduction on contribution when we use our state 529 plans. Some states, such as California, do not offer a tax deduction on contribution regardless of what 529 plans we use. We want to check with our state to see if they offer a tax deduction on contribution into a 529 plan. The tax benefits in 529 plans are tax-deferral (buying and selling investments inside the account does not trigger a taxable event) and the earnings are tax-free when used on qualified educational expenses.

“For purposes of qualified tuition programs (QTP), also referred to as a section 529 plan, “qualified higher education expenses include tuition expenses in connection with a designated beneficiary's enrollment or attendance at an elementary or secondary public, private, or religious school, i.e., kindergarten through grade 12, up to a total amount of $10,000 per year from all of the designated beneficiary's QTPs. They also include expenses for fees, books, supplies, and equipment required for the participation in an apprenticeship program registered and certified with the Secretary of Labor and qualified education loan repayments in limited amounts.”

https://www.irs.gov/taxtopics/tc313

The earnings are not taxed if used for qualified higher educational expenses. No income phaseout on the contributions or distributions. Distribution is a pro rata basis which consists of two parts – return of principal and earnings.

For Coverdell ESAs and 529 plans, the distributions for qualified education expenses must be incurred in the same tax year. The IRS does not allow reimbursement for prior year expenses.

https://www.irs.gov/publications/p970

How am I helping my clients utilize 529 plans in their financial plan? For some of my clients, we use 529 plans for multigenerational college planning. The money can fund the education of their children and maybe even generations beyond that. a 529 plan is a revocable, irrevocable gift. We can control the 529 plan and it’s out of our gross estate. Compared to moving our assets to an irrevocable trust to reduce our gross estate where it’s hard to change once the trust terms are established. You can learn more about 529 Plans in this educational video.

https://tanphan.com/blog/529plans

Tax Deadlines

These are the following tax deadlines. If we have to make estimated tax payments, we want to make sure we pay our estimated tax payments before the due date because we don’t want to be penalized for underpayment of estimated tax. “For estimated tax purposes, the year is divided into four payment periods. Each period has a specific payment due date. If you don’t pay enough tax by the due date of each of the payment periods, you may be charged a penalty even if you are due a refund when you file your income tax return.”

https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes

We should also know the safe harbor for estimated tax rules to avoid the underpayment penalties. “Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.”

https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes

Retirement Plan Contribution Limits

Types of contributions:

• “A contribution is the amount an employer and employees (including self-employed individuals) pay into a retirement plan. There are limits to how much employers and employees can contribute to a plan (or IRA) each year. The plan must specifically state that contributions or benefits cannot exceed certain limits. The limits differ depending on the type of plan.”

https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-contributions

• “Employer contributions

— Employer matching contributions. If the plan document permits, the employer can make matching contributions for an employee who contributes elective deferrals (for example, 50 cents for each dollar deferred). Employer matching contributions can be discretionary (contributed in some years and not in others, depending on the company's decision) or mandatory, as in SIMPLE plans and Safe Harbor 401(k) plans.

— Employer discretionary or non-elective contributions. If the plan document permits, the employer can make contributions other than matching contributions for participants. These contributions are made on behalf of all employees who are plan participants, including participants who choose not to contribute elective deferrals.

• Types of employee contributions

— Salary reduction/elective deferral contributions are pre-tax employee contributions that are a generally a percentage of the employee's compensation. Some plans permit the employee to contribute a specific dollar amount each pay period. 401(k), 403(b) or SIMPLE IRA plans may permit elective deferral contributions.

— Designated Roth contributions are a type of elective contribution that, unlike pre-tax elective contributions, are currently includible in gross income but tax-free when distributed. 401(k), 403(b) and governmental 457(b) plans can allow them. If a plan permits designated Roth contributions, it must also offer pre-tax elective deferral contributions.

— After-tax contributions are contributions from compensation (other than Roth contributions) that an employee must include in income on his or her tax return. If a plan allows after-tax contributions, they are not excluded from income and an employee cannot deduct them on his or her tax return.

— Catch-up contributions if permitted by a 401(k), 403(b), governmental 457(b), SARSEP or SIMPLE IRA plan, participants who are age 50 or over at the end of the calendar year can also make catch-up elective deferral contributions beyond the basic limit on elective deferrals.”

https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-contributions

Defined benefit plans vs. Defined contribution plans

Qualified plans can be categorized as either defined contribution plans or defined benefit plans. While all defined benefit plans fall under the category of pension plans, defined contribution plans can be either pension plans or profit sharing plans. The key distinctions between these classifications include the assumption of investment risk, the allocation of plan forfeitures, coverage under the Pension Benefit Guaranty Corporation (PBGC), the calculation of accrued benefits or account balances, and the potential to grant credit for employees' prior service.

The annual compensation used to determine contribution for most plans is $345,000. This means the compensation limit sets a maximum threshold for determining employer contributions received by highly-paid participants in company plans such as SEP and SIMPLE IRAs. This limit also plays a role in performing nondiscrimination testing for 401(k) and 403(b) plans. For 2024, the compensation limit is set at $345,000. It's important to note that the majority of employees will not be impacted by this limit. If your pay exceeds the cap, it does not disqualify you from receiving a contribution. However, any amount exceeding $345,000 cannot be factored into the calculation of the company contribution on your behalf. Contributions made by the company in 401(k) and 403(b) plans can take the form of either matching contributions (for employees who defer a portion of their salary) or a flat contribution provided to all eligible employees regardless of their deferrals. In both cases, the compensation limit still applies.

Another way to say this is that any compensation exceeding the limit is not eligible for contribution. Employees who earn more than the limit can still make the maximum salary deferral to their employer's 401(k) plan, but the employer's matching contribution will only be applied up to the limit.

“Example: Your plan requires a match of 50% on salary deferrals that do not exceed 5% of compensation. Although Mary earned $360,000, your plan can only use up to $280,000 of her compensation when applying the matching formula for 2019. Mary’s matching contribution would be $7,000 (50% x (5% x $280,000)). Although Mary makes salary deferrals of $19,000, only $14,000 (5% of $280,000) will be matched. She must receive a matching contribution of $7,000 (50% x $14,000) under the terms of the plan.”

https://www.irs.gov/retirement-plans/401k-plans-deferrals-and-matching-when-compensation-exceeds-the-annual-limit

Defined-contribution plans basic limit is $69,000. $69,000 is the total maximum amount the employER and employEE can contribution into the plan not including the employEE catch-up contribution. Normally, the employEE contributes into the plan via elective salary deferral and the employER contributes to the employee’s plan via a matching contribution.

“The annual additions paid to a participant’s account cannot exceed the lesser of:

1. 100% of the participant's compensation, or

2. $69,000 ($76,500 including catch-up contributions) for 2023”

https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits

“Compensation limit for contributions. Remember that annual contributions to all of your accounts maintained by one employer (and any related employer) - this includes elective deferrals, employee contributions, employer matching and discretionary contributions and allocations of forfeitures, to your accounts, but not including catch-up contributions - may not exceed the lesser of 100% of your compensation or [$69,000 for 2024]. This limit increases to [$76,500 for 2024]; if you include catch-up contributions. In addition, the amount of your compensation that can be taken into account when determining employer and employee contributions is limited to [$345,000 for 2024].”

https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits

Defined-benefit plans basic limit is $275,000 which is the maximum amount we can receive annually. “Defined benefit plans limit how much you can receive. Participants can receive an annual maximum compensation of either 100% of the employee's average salary for their highest-earning three consecutive calendar years or, a maximum of $265,000 in 2023 or $275,000 in 2024.”

https://www.thrivent.com/insights/retirement-planning/defined-benefit-vs-defined-contribution-plan-whats-the-difference

“Contributions to a defined benefit plan are based on what is needed to provide definitely determinable benefits to plan participants. Actuarial assumptions and computations are required to figure these contributions.

In general, the annual benefit for a participant under a defined benefit plan cannot exceed the lesser of:

1. 100% of the participant's average compensation for his or her highest 3 consecutive calendar years, or”

2. $275,000 for 2024

https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-defined-benefit-plan-benefit-limits

401(k), 403(b), 457(b), Roth 401(k) plans elective deferrals is $23,000. This is the maximum amount the employEE can contribute via elective salary deferral.

The catch-up provision for individuals 50 and over contributing to 401(k), 403(b), 457 (b), Roth 401(k) plans is $7,500. This means if we are 50-year-old or older, we can contribution an additional amount of $7,500 into the plan. This is different from the catch-up provision for individuals 50 and over contributing to IRAs in the amount of $1,000.

Using the 2019 limits:

The basic limit on elective deferrals is…$19,000 in 2019, or 100% of the employee's compensation, whichever is less.

https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-contributions

“Employee deferrals are included as part of the employee's annual funding limit of the lesser of 100 percent of income or $56,000 for 2019. However, the catch-up contributions do not count against this limit and, therefore, allow a participant who is age 50 or older to increase the maximum contributions to qualified plans to $62,000 for 2019.”

Dalton, James F., and Michael Dalton. Retirement Planning and Employee Benefits. 2019.

“It is important to note that the catch up provision is only employee funded. An employer cannot make the contribution for the employee and an employee that did not have access to a cash or deferred arrangement could not exceed the IRC §415(c) limit.”

Dalton, James F., and Michael Dalton. Retirement Planning and Employee Benefits. 2019.

For example, “Andrea, age 50, has a salary of $160,000. She chooses to defer $25,000 [$19,000 + $6,000] for 2019 into the 401(k) plan. The employer may also contribute up to $40,000 ($160,000 x 25%) to the plan (not her account). Note that the employer's contribution to her account will be limited to $37,000 due to the maximum annual contribution limit of $56,000. In total for the year, Andrea would have contributions to qualified plans totaling $62,000” ($19,000 employEE contribution + $37,000 employER contribution + $6,000 employEE catch-up contribution).

Dalton, James F., and Michael Dalton. Retirement Planning and Employee Benefits. 2019.

“A SIMPLE IRA plan (Savings Incentive Match Plan for Employees) allows employees and employers to contribute to traditional IRAs set up for employees. It is ideally suited as a start-up retirement savings plan for small employers not currently sponsoring a retirement plan.”

https://www.irs.gov/retirement-plans/plan-sponsor/simple-ira-plan

SIMPLE plans, for 2024, the “annual employee salary reduction contributions (elective deferrals) [is] limited to [$16,000]. For employees age 50 or over, a $3,500 “catch-up” contributions is also allowed.”

https://www.irs.gov/retirement-plans/plan-sponsor/simple-ira-plan

This means if an employEE is 50-years-old, the employEE can contribute up to $19,500 for 2024.

Let’s talk about Simplified Employee Pension Plan (SEP) although it is not included in the table. SEP-IRA contribution limit is the lesser of 25% of compensation or $69,000 for 2024.

https://www.irs.gov/retirement-plans/cola-increases-for-dollar-limitations-on-benefits-and-contributions

“If I participate in a SEP plan, can I contribute to a Roth IRA in addition to receiving contributions under the SEP plan?

A SEP-IRA is a traditional IRA that holds contributions made by an employer under a SEP plan. You can both receive employer contributions to a SEP-IRA and make regular, annual contributions to a traditional or Roth IRA. Employer contributions made under a SEP plan do not affect the amount you [employEE] can contribute to an IRA on your own behalf.

”Nancy, age 45, is the owner and sole employee of JJ Investment Advisors. Nancy contributes the maximum allowable amount to her SEP-IRA for 2019, or $56,000. Nancy may also make regular, annual IRA contributions to her SEP-IRA, if her SEP-IRA allows this, or contribute to her Roth IRA at XYZ Investment Co. Her total traditional IRA and Roth IRA contributions cannot exceed $6,000 for 2019 and may be made in addition to her SEP contributions.”

https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-seps

Distributions from pre-tax accounts, such as pre-tax 401(k) Plans and Traditional IRAs, the amount distributed are subjected to income tax but it does not mean we have to pay taxes on them because it depends on our tax bracket.

Individual Retirement Accounts

The contribution limit for IRAs is $7,000. “The total contributions you make each year to all of your traditional IRAs and Roth IRAs can't be more than:

• [$7,000] ([$8,000] if you're age 50 or older), or

• If less, your taxable compensation for the year.”

https://www.irs.gov/retirement-plans/cola-increases-for-dollar-limitations-on-benefits-and-contributions

Regardless of how many IRAs we have, the maximum we can contribute is $7,000 ($8,000 if we are 50-year-old or older).

Traditional nondeductible means we cannot claim a tax-deductible on the contribution on our tax return.

Traditional deductible means the contribution may be tax-deductible on our tax return, but “the deduction may be limited if you or your spouse is covered by a retirement plan at work and your income exceeds certain levels.”

https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

“Traditional IRAs

• Retirement plan at work: Your deduction may be limited if you (or your spouse, if you are married) are covered by a retirement plan at work and your income exceeds certain levels.

• No retirement plan at work: Your deduction is allowed in full if you (and your spouse, if you are married) aren’t covered by a retirement plan at work.”

https://www.irs.gov/retirement-plans/ira-deduction-limits

The income limit is the income phase‑out ranges for deducting the contribution to a traditional IRA and for how much to contribute to a Roth IRA.

“Roth IRA contributions aren’t deductible.”

https://www.irs.gov/retirement-plans/ira-deduction-limits

There is no income limit on Roth conversion. A person can make as much money as they want for the year and still be able to do the Roth conversion. A Roth conversion is converting deductible money and non-deductible money to Roth money. An example is doing a Roth conversion from a 401(k) Plan where the money has not been taxed to a Roth 401(k) Plan where the money at withdrawal can be tax-free as long as it’s a qualified distribution. Another example is doing a Roth conversion from a Traditional IRA with deductible or non-deductible contributions to a Roth IRA where the money at withdrawal can be tax-free as long as it’s a qualified distribution. Normally, the amount being converted will be subject to taxes unless the amount is non-deductible. For example, if a Traditional IRA has $100,00 of nondeductible contributions and $500,000 of gains, only the $500,000 of gains are subject to taxes when doing a Roth conversion.

Roth accounts (such as, Roth IRAs and Roth 401(k) Plans) are more valuable than after-tax accounts (such as, taxable accounts and after-tax contributions to a 401(k) plan). After-tax accounts are more valuable than pre-tax accounts (such as, 401(k) plans, 403(b) plans, 457(b) plans, Traditional IRAs, tax-shelter annuities).

Roth dollars are more valuable than after-tax dollars because we can buy and sell inside the Roth accounts and it will not trigger a taxable event. This is called tax-deferral. The gains in the Roth accounts are tax-free as long as it’s a qualified distribution. There are no required minimum distributions on Roth accounts.

After-tax dollars are more valuable than pre-tax dollars because we already pay taxes on the after-tax dollars. Gains will be taxed at capital gains tax rates or ordinary income tax rates, depending on the types of accounts and holding period. With pre-tax dollars, we have not paid taxes on the money. Therefore, after-tax dollars are more valuable than pre-tax dollars.

Health Savings Accounts

What is an Health Savings Account (HSA)?

An Health Savings Account is one of the various tax advantages programs designed to help us offset health care costs. There are Health Savings Accounts (HSAs), Medical Savings Accounts (Archer MSAs and Medicare Advantage MSAs), Health Flexible Spending Arrangements (FSAs), and Health Reimbursement Arrangements (HRAs).

HSAs offer triple tax advantages: contributions are tax deductible, tax-deferral (buying and selling investments inside the account does not trigger a taxable event), qualified withdrawals for health expenses are tax-free.

“An HSA may receive contributions from an eligible individual or any other person, including an employer or a family member, on behalf of an eligible individual. Contributions, other than employer contributions, are deductible on the eligible individual’s return whether or not the individual itemizes deductions. Employer contributions aren’t included in income. Distributions from an HSA that are used to pay qualified medical expenses aren’t taxed.”

https://www.irs.gov/publications/p969

What are the benefits of an Health Savings Account (HSA)?

•“You can claim a tax deduction for contributions you, or someone other than your employer, make to your HSA even if you don’t itemize your deductions on Schedule A (Form 1040).

•Contributions to your HSA made by your employer (including contributions made through a cafeteria plan) may be excluded from your gross income.

•The contributions remain in your account until you use them.

•The interest or other earnings on the assets in the account are tax free.

•Distributions may be tax free if you pay qualified medical expenses. See Qualified medical expenses, later.

•An HSA is “portable.” It stays with you if you change employers or leave the work force.”

•“Under the last-month rule, you are considered to be an eligible individual for the entire year if you are an eligible individual on the first day of the last month of your tax year (December 1 for most taxpayers).”

https://www.irs.gov/publications/p969

What are the Health Savings Account (HSA) limits for 2024?

•The annual maximum deductible contribution is the amount we can contribute and take a tax deduction for the contribution on our federal tax return. The maximum deductible contribution is $4,150 for individuals (self-only) coverage and $8,300 for families coverage. For eligible individuals who are 55 or older, they can contribute an additional $1,000. This is called the catch-up contribution.

“Under the tax law, HSA-eligible plans must set a minimum deductible and a limit, or maximum, on out-of-pocket costs for both individuals and families.”

•The expense limits (deductibles and co-pays) is “the maximum out-of-pocket costs are the most you’d have to pay per year if you need more health care items and services.” The maximum out-of-pocket cost cannot exceed $8,050 for individuals (self-only) coverage and $16,100 for families coverage.

•The minimum annual deductible limits is “the minimum deductible is the amount you pay for health care items and services per year before your plan starts to pay.” The minimum annual deductible for individuals (self-only) coverage is $1,600 and families coverage is $3,200.

https://www.healthcare.gov/high-deductible-health-plan

What we should know about Health Savings Accounts (HSA):

•“Any eligible individual can contribute to an HSA. For an employee’s HSA, the employee, the employee’s employer, or both may contribute to the employee’s HSA in the same year. For an HSA established by a self-employed (or unemployed) individual, the individual can contribute. Family members or any other person may also make contributions on behalf of an eligible individual.

•Contributions to an HSA must be made in cash. Contributions of stock or property aren’t allowed”

•“Each spouse who is an eligible individual who wants an HSA must open a separate HSA. You can’t have a joint HSA.”

•“If you have more than one HSA in 2022, your total contributions to all the HSAs can’t be more than the limits discussed earlier.”

•“A rollover contribution isn’t included in your income, isn’t deductible, and doesn’t reduce your contribution limit.”

•“Generally, you must pay a 6% excise tax on excess contributions. See Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts, to figure the excise tax. The excise tax applies to each tax year the excess contribution remains in the account.

You may withdraw some or all of the excess contributions and avoid paying the excise tax on the amount withdrawn…”

•“If you are no longer an eligible individual, you can still receive tax-free distributions to pay or reimburse your qualified medical expenses.”

https://www.irs.gov/publications/p969

•If your spouse is also 55 or older, he or she may establish a separate HSA and make a “catch-up” contribution to that account.”

•”You have until the tax filing deadline (typically April 15) to make contributions to your HSA for the previous year.”

https://www.optumbank.com/resources/library/contribution-limits.html

Deductibility of Long-Term Care Premiums on Qualified Policies

Deducting long-term care insurance premiums depends on several factors, including the type of policy, our age, and our total medical expenses.

Attained age before close of tax year is how old are we at the end of the year. Amount of LTC premiums that qualify as medical expenses is “the maximum amount of qualified long-term care premiums includible as medical expenses... Qualified long-term care premiums up to the amounts shown…can be included as medical expenses on Schedule A (Form 1040), Itemized Deductions, or in calculating the self-employed health insurance deduction. The limit on premiums is for each person.”

https://apps.irs.gov/app/vita/content/00/00_25_005.jsp

The amount of LTC premiums that qualify as medical expenses in 2024 for age 40 or under is $470, age 41 to 50 is $880, age 51 to 60 is $1,760, age 61 to 70 is $4,710, and age 71 and over is $5,880. The amount is an annual number.

”If you itemize your deductions for a taxable year on Schedule A (Form 1040), Itemized Deductions, you may be able to deduct the medical and dental expenses you paid for yourself, your spouse, and your dependents during the taxable year to the extent these expenses exceed 7.5% of your adjusted gross income for the year. The deduction applies only to expenses not compensated by insurance or otherwise regardless of whether you receive the reimbursement directly or payment is made on your behalf to the doctor, hospital, or other medical provider…Deductible medical expenses may include but aren't limited to the following:...Amounts paid for insurance premiums to cover medical care or qualified long-term care.”

https://www.irs.gov/taxtopics/tc502

“In order to benefit from the tax deduction on your long-term care insurance premiums, you'll need to itemize your deductions on your federal income tax return. Additionally, your total qualified medical expenses, including the premiums, must exceed 7.5% of your adjusted gross income (AGI) to be eligible for the deduction. If your expenses fall below this threshold, you won't be able to deduct them, according to the IRS.”

https://www.cbsnews.com/news/are-long-term-care-insurance-premiums-tax-deductible

For example, our adjusted gross income (AGI) is $100,000. On Form 1040, line 11, that is our adjusted gross income. We transfer that amount to Schedule A, line 2. 7.5% of $100,000 is $7,500. We enter that amount on Schedule A, line 3. If we are 65-year-old and we have $4,000 of LTC premium for the year, our total qualified medical expenses are $10,000 including the LTC premium, we enter that amount on Schedule A, line 1. “Subtract line 3 from line 1” which is $10,000 minus $7,500 equals $2,500. We enter $2,500 on Schedule A, line 4. $2,500 is the amount we could tax deduct to arrive at our total itemized deductions. We transfer the total itemized deductions to Form 1040, line 12, and then subtract that amount to our adjusted gross income to lower our taxable income.

Schedule A

https://www.irs.gov/pub/irs-pdf/f1040sa.pdf

Form 1040

https://www.irs.gov/pub/irs-pdf/f1040.pdf

Self-employed individuals may be able to deduct a portion of their long-term care insurance premiums as a business expense, provided that specific conditions are met. According to the IRS, ”Health Insurance Costs of Self-Employed Individuals — If you're self-employed and have a net profit for the year, you may be eligible for the self-employed health insurance deduction. This is an adjustment to income, rather than an itemized deduction, for premiums you paid on a health insurance policy covering medical care, including a qualified long-term care insurance policy for yourself, your spouse, and dependents. The policy can also cover your child who is under the age of 27 at the end of the year even if the child wasn't your dependent. See the Instructions for Form 7206. If you don't claim 100% of your paid premiums, you can include the remainder with your other medical expenses as an itemized deduction on Schedule A (Form 1040).”

https://www.irs.gov/taxtopics/tc502

”The insurance policy itself must also meet certain requirements for the premiums to be deductible. For instance, it can only cover long-term-care services. This limitation means the deduction “only applies to traditional long-term-care policies”—not “hybrid” policies that combine life insurance with long-term-care benefits, says Jesse Slome, executive director of the American Association for Long-Term Care Insurance.”

https://www.kiplinger.com/article/retirement/t036-c005-s004-deduct-expenses-for-long-term-care-on-your-tax-return.html

I made an educational video on long-term care planning, and I hope you will benefit from it.

https://tanphan.com/blog/long-term-care-insurance

Medicare Deductibles

What is Medicare?

• “Medicare is a federal health insurance program for individuals aged 65 or older. Younger individuals with certain disabilities or specific medical conditions also qualify for Medicare. There are four main parts in Medicare which each help cover specific services.

– “Medicare Part A (Hospital Insurance). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

– Medicare Part B (Medical Insurance). Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

– Medicare Part D (prescription drug coverage). Helps cover the cost of prescription drugs (including many recommended shots or vaccines).”

https://www.medicare.gov/what-medicare-covers/your-medicare-coverage-choices/whats-medicare

–Medicare Advantage (also known as Part C) “is a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D. In most cases, you’ll need to use doctors who are in the plan’s network. Plans may have lower out-of-pocket costs than Original Medicare. Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.”

https://www.medicare.gov/basics/get-started-with-medicare/medicare-basics/parts-of-medicare

• “Medicare Supplemental Insurance (Medigap): Extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare. Policies are standardized, and in most states named by letters, like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it.”

https://www.medicare.gov/basics/get-started-with-medicare/medicare-basics/parts-of-medicare

• What's the difference between Medicare Advantage and Medigap? Medigap allows you to consult with any doctor accepting Medicare. Medicare Advantage requires receiving care from the plan's network of doctors and hospitals, except in urgent or emergency situations.

• We usually enroll in Medicare a few months before we turn 65 years old because it takes time to enroll. Automatic enrollment applies to some of us, while others sign up during enrollment periods.

What is a deductible in insurance?

A deductible is the amount of money we pay out of our pocket before our insurance coverage kicks in to cover qualified expenses. Once our deductible is met, the insurance provider will pay for the covered cost. They might pay for all the costs or share the costs with us, known as coinsurance or copayments. Coinsurance represents the percentage of expenses we pay after our deductible are met. Copayment is a fixed amount we pay for prescriptions, doctor visits, and various types of care and it’s normally paid before our deductible is met.

Medicare deductibles

There are deductibles in Medicare Part A and Part B. Part C and Part D varies by plan. For 2024, the deductible for Part A is “$1,632 for each inpatient hospital benefit period, before Original Medicare starts to pay. There’s no limit to the number of benefit periods you can have in a year. This means you may pay the deductible more than once in a year.”

https://www.medicare.gov/basics/costs/medicare-costs

“Inpatient stay

Days 1-60: $0 after you pay your Part A deductible.

Days 61-90: $408 copayment each day.

Days 91-150: $816 copayment each day while using your 60 lifetime reserve days.

After day 150: You pay all costs.”

https://www.medicare.gov/basics/costs/medicare-costs

For 2024, the deductible for Part B is “$240 before Original Medicare starts to pay. You pay this deductible once each year.”

https://www.medicare.gov/basics/costs/medicare-costs

Social Security

Social Security benefits

The estimated maximum monthly benefit if turning full retirement age at 66-year-old in 2024 is $3,822 per month.

The retirement earnings exemption amounts are the amount we can earn before our Social Security benefits get reduced.

“How much can you earn and still get benefits? If you were born January 2, 1960 or later, then your full retirement age for retirement insurance benefits is 67. If you work, and are at full retirement age or older, you may keep all of your benefits, no matter how much you earn. If you’re younger than full retirement age, there is a limit to how much you can earn and still receive full Social Security benefits. If you’re younger than full retirement age during all of 2024, we must deduct $1 from your benefits for each $2 you earn above $22,320. If you reach full retirement age in 2024, we must deduct $1 from your benefits for every $3 you earn above $59,520 until the month you reach full retirement age.”

https://www.ssa.gov/pubs/EN-05-10069.pdf

“If you are younger than full retirement age and earn more than the yearly earnings limit, we may reduce your benefit amount. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. For 2024, that limit is $22,320. In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit. In 2024, this limit on your earnings is $59,520. We only count your earnings up to the month before you reach your full retirement age, not your earnings for the entire year.”

https://www.ssa.gov/benefits/retirement/planner/whileworking.html

“When you reach full retirement age:

• Beginning with the month you reach full retirement age, your earnings no longer reduce your benefits, no matter how much you earn.

• We will recalculate your benefit amount to give you credit for the months we reduced or withheld benefits due to your excess earnings.”

https://www.ssa.gov/benefits/retirement/planner/whileworking.html

“When we figure out how much to deduct from your benefits, we count only the wages you make from your job or your net profit if you're self-employed. We include bonuses, commissions, and vacation pay. We don't count pensions, annuities, investment income, interest, veterans benefits, or other government or military retirement benefits.”

https://www.ssa.gov/benefits/retirement/planner/whileworking.html

Tax on Social Security benefits: income brackets

Up to 85% of our Social Security benefits could be taxed. The amount of Social Security benefits subject to tax depends on our provisional income. Provisional income is adjusted gross income (not including Social Security) plus tax-exempt interest plus 50% of Social Security benefit.

FICA Tax

What is FICA? “FICA is a U.S. federal payroll tax. It stands for the Federal Insurance Contributions Act and is deducted from each paycheck. Your nine-digit number helps Social Security accurately record your covered wages or self-employment. As you work and pay FICA taxes, you earn credits for Social Security benefits.”

https://www.ssa.gov/people/materials/pdfs/EN-05-10297.pdf

Social Security tax and Medicare tax are commonly referred to as the FICA tax which applies to employers and employees.

“The current tax rate for Social Security is 6.2% for the employer and 6.2% for the employee, or 12.4% total.”

“Only the Social Security tax has a wage base limit. The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2024, this base is $168,600.”

https://www.irs.gov/taxtopics/tc751

FICA is a “federal law that requires employers to pay and withhold certain taxes from the wages they pay employees. FICA mandates that three separate taxes be withheld from an employee's gross earnings:

• 6.2% Social Security tax, withheld from the first [$168,600] an employee makes in [2024].

• 1.45% Medicare tax, withheld on all of an employee’s wages.

• 0.9% Medicare surtax withheld on single filer employee wages over $200,000 per calendar year (over $250,000 for joint filers).”

https://turbotax.intuit.com/tax-tips/general/fica-and-withholding-everything-you-need-to-know/L8Vjhsiel

Maximum tax payable is the maximum tax we pay relating to Social Security in FICA. The Social Security tax paid on income up to $168,600 X 6.2% = $10,432.20. $10,432.20 for an employee and $10,432.20 for an employer relating to that employee. The Social Security tax paid on income up to $168,600 X 12.4% = $20,906.40. $20,906.40 is for self-employed individuals.

Medicare tax

“The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.”

https://www.irs.gov/taxtopics/tc751

“Additional Medicare tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers are responsible for withholding the 0.9% Additional Medicare tax on an individual's wages paid in excess of $200,000 in a calendar year, without regard to filing status…and continue to withhold it each pay period until the end of the calendar year.”

https://www.irs.gov/taxtopics/tc751