Tax Guide and Resources for 2024 (Abstract)

Hi everyone, my name is Tan, and I am an independent CERTIFIED FINANCIAL PLANNER™ practitioner at TAN Wealth Management. Today’s educational video is a sneak peek of the tax guide and resources for 2024 and a more detailed article is on my website at tanphan.com.

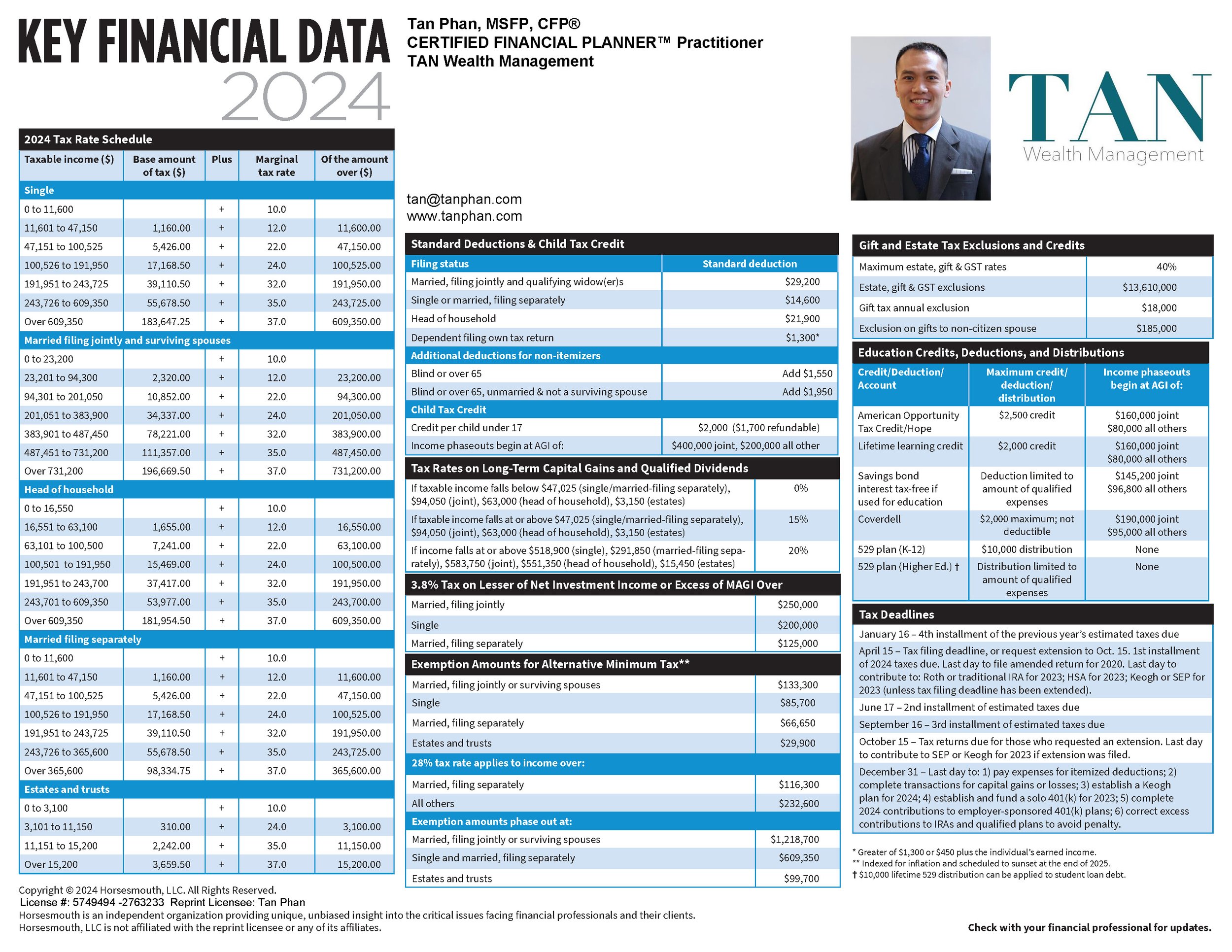

2024 Tax Rate Schedule

• There are seven tax brackets for the 2024 tax year for filing status single, married filing jointly and surviving spouses, head of household, and married filing separately. There are four tax brackets for the 2024 tax year for estate and trusts.

• If everything is the same, if the taxable income range increases in the brackets, we will pay less in taxes. If the taxable income range decreases in the brackets, we will pay more in taxes because more of our taxable income is subject to the higher tax rate.

• A tax bracket is a range of income where a specific tax rate applies. Each bracket corresponds to a tax rate where the income falls in that bracket is taxed at that specific tax rate.

• We are in a progressive tax system, where tax rates increase as our income rises.

• A marginal tax rate is a percentage of tax applied to the last dollar of income earned.

• An effective tax rate is total tax paid divided by total income earned. It is our average tax rate.

• For example, 10% tax rate applied to the first $10,000, 20% tax rate applied to the next $20,000, and 30% tax rate applied to the next $30,000. Our taxable income is $60,000. Our marginal tax rate is 30% because that is the rate on the last dollar taxed. Our effective tax rate is 23% and it derives from total tax liability of $14,000 divided by taxable income of $60,000. This also illustrate a progressive tax structure where a range of taxable income are being taxed at specific tax rate. The higher our income, the higher the tax rate on that income.

• With the estates and trusts tax rate for the 2024 tax year, we could be at the 37% tax rate when taxable income is above $15,200. By comparison, the tax rate for single filers on taxable income between $11,601 to $47,150 is 12%. To reach the 37% tax rate for single filers, taxable income needs to be over $609,350. We want to keep this in mind when we are structuring and handling trusts. We really have to know how the money flows from us to the trust to the beneficiary and how it’s taxed.

Standard Deductions & Child Tax Credit

• A standard deduction is a fixed dollar amount normally adjusted for inflation that reduces the income on which we are taxed. We subtract the standard deduction from our adjusted gross income (AGI) to reduce our taxable income. It is a simpler method to decrease our taxable income and the deduction amount is determined by the tax filing status.

• People who are blind or over age 65 receive an extra deduction to help them reduce their taxable income.

• The child tax credit is per qualifying child. The credit is partial refundable and there is an income phaseout.

• A tax credit is better than a tax deduction because a tax credit is a dollar-for-dollar reduction on the income tax we owe.

Tax Deductions versus Tax Credits

Here is a simplified version of understanding the impact of tax deductions versus tax credits

Example 1, taking a tax deduction:

We made $100,000 of earned income

Taking a tax deduction of $10,000

Taxable income of $90,000

Assuming a flat tax of 20%

$90,000 multiplied by 20% equals $18,000 in tax liability

Example 2, taking a tax credit:

We made $100,000 of earned income

Taxable income of $100,000 because we are not taking any tax deduction

Assuming a flat tax of 20%

$100,000 multiplied by 20% equals $20,000

$20,000 minus a tax credit of $10,000 equals $10,000 of tax liability

This is what I meant by a tax credit is a dollar-for-dollar reduction on the income taxes we owe.

Refundable Tax Credits versus Nonrefundable Tax Credits

With tax credits, the tax credits can be refundable tax credits or non-refundable tax credits. What is the difference between a refundable tax credit and a nonrefundable tax credit? We benefit more from refundable tax credits because they provide the potential for a cash refund.

Here is an example of a refundable versus nonrefundable tax credit.

• Refundable tax credit. We have a $1,000 tax liability, we claimed a $3,000 refundable tax credit, the $3,000 offset the $1,000 tax liability and we get a check for $2,000.

• Nonrefundable tax credit. We have a $1,000 tax liability, we claimed a $3,000 nonfundable tax credit, the $3,000 offset the $1,000 tax liability and we do not get a check for the excess amount of $2,000 because the nonrefundable tax credit will only offset up to our tax liability.

Tax Rates on Long-Term Capital Gains and Qualified Dividends

• There are three tax brackets in long-term capital gains and qualifying dividends.

• Net long-term capital gains are taxed at graduated tax rates with other exceptions.

• Net short-term capital gains are taxed at graduated ordinary income tax rates. Net long-term capital gains are taxed at graduated long-term tax rates. If we have $1 million in net long-term capital gains, we will be subjected to all three capital gains tax rates.

• Qualified dividends are taxed at capital gains tax rates. Non-qualified or “ordinary” dividends are taxed at ordinary income tax rates.

The 3.8% Net Investment Income Tax

• The Net Investment Income Tax “applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts.”

• The 3.8% Net Investment Income Tax applies on the lesser of the taxpayer’s net investment income or the amount that exceeds the taxpayer’s modified adjusted gross income (MAGI) as shown on the tax guide.

• These threshold amounts are not indexed for inflation.

• Some strategies that could avoid the NIIT are to keep our modified adjusted gross income below the statutory threshold, avoid increasing taxable income when we don’t have to, increase net investment expenses, contribute to accounts that can reduce our income, installment sales, Sell investments at a loss to offset investment gains, Defer capital gain, use Section 1031 like-kind exchange, and use Section 1035 exchange.

• For more details on the NIIT, check out this video.

https://tanphan.com/blog/what-is-the-38-net-investment-income-tax-niit

Tax Planning Tips and Insights

• We want to ensure that we are getting every tax deduction and credit we are entitled to because we work hard for our money.

• We want to understand our tax bracket, maximize retirement contributions, take advantage of tax credits, utilize tax deductions, consider taking itemized deductions if the itemizing deduction is higher than taking the standard deduction, invest and withdraw tax-efficiently, capitalize on tax-loss harvesting and tax-gain harvesting when it’s to our advantage, utilize tax advantage accounts (HSA, FSA, 529 Plans, etc.), and control our tax liability through bracket management. When I do financial planning for my clients, I use a tax software to run scenario analysis because most of the decisions we make will have some sort of tax implications.

• Each layer of complexity heightens the risk of error; thus, sometimes simple is best.

Please note that this material is for educational use only. Tax laws are written in pencil; they can always be rewritten. Tax laws are complex, there are exceptions to the rules, and it’s constantly changing so don’t do it alone. Be sure to talk to a qualified professional before making an informed decision. I hope you enjoyed this video and thank you for watching it. Until next time, this is Tan, your trusted advisor.